Federal Withholding Tax

Published:

Information About Federal Income Tax Withholding

The Federal income tax is based on a “pay-as-you-go” system. There aretwo ways to pay as you go: withholding tax or estimated tax. This article discusses withholding tax (also referred to as “tax withholding”).

If you work at a job, your employer most likely withholds income tax from your paychecks. (Tax may also be withheld from other types of income – such as commissions, bonuses, and pensions.) The tax withheld is sent to the IRS on your behalf and the funds are applied to your Social Security, Medicare, and income taxes for the year. The amount withheld in each category is reported on your Form W-2 (Wage and Tax Statement), which you receive from your employer.

NOTE: If you live in a State that imposes income tax, your State income tax is usually withheld as well.

How Is Withholding Tax Determined?

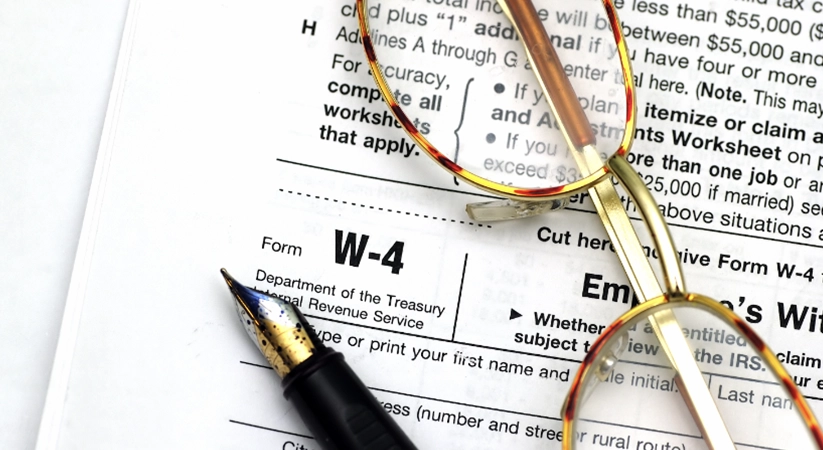

The amount of tax withheld from your regular pay depends on two things: how much money you earn and the information you provide on IRS Form W-4 (Employee’s Withholding Allowance Certificate). Using Form W-4, you must report how many personal allowances you are claiming for the tax year. The number of allowances you can claim is based on your particular situation. There is a “Personal Allowances Worksheet” on Page 3 of Form W-4 to help you determine this number.

Note that each allowance you claim will lower the amount of tax withheld from your earnings. It’s generally recommended that you have 90% of your estimated income taxes withheld from your wages. You can find out if you’re withholding the right amount by using the IRS Withholding Tax Calculator online tool.

Withholding: Social Security and Medicare Tax

Social Security and Medicare taxes are automatically withheld by your employer and have fixed rates.

The Social Security tax rate is currently 6.2% for the employer and 6.2% for the employee, which is 12.4% total. The Social Security tax has a wage base limit of $128,400 for the 2018 tax year. In other words, it’s the maximum amount of earnings that is subject to Social Security tax. This means that most employees are required to pay 6.2% Social Security tax on the first $128,400 of their wages.

The Medicare tax rate is currently 1.45% for the employer and 1.45% for the employee, which is 2.9% total. Unlike the Social Security tax, the Medicare tax has no wage base limit. This means that all covered wages are subject to Medicare tax.

See IRS Publication 15 (Employer’s Tax Guide) for more information.

Withholding: Federal Income Tax

The amount of Federal income tax withheld from your pay is based on the information you provide on IRS Form W-4. When you start a new job, you are required to fill out Form W-4 and give it to your employer. If you need/want to make changes to your withholding tax at any point during the year, you must complete and submit a new W-4 tax form.

For example, if you find that too much or too little tax was withheld last year, you can fill out a new Form W-4 to adjust your withholding. Additionally, certain life events (such as marriage, divorce, or the birth of a child) may change your filing status or the number of allowances you can claim. In these cases, you will need to give your employer a new Form W-4 to adjust your withholding status and/or number of allowances.

On Form W-4, there are three main types of information that your employer will use to calculate your withholding tax:

- Your withholding status (tells your employer whether to withhold at the “Single” tax rate or the lower “Married” tax rate)

- The number of withholding allowances you claim (each allowance reduces the amount of tax withheld)

- Whether you want an additional amount withheld

The more allowances you claim, the less income tax your employer will withhold. Claiming “0” allowances means you will have the most tax withheld from your pay. Based on your withholding status and allowances, your employer will use the IRS Income Tax Withholding Tables to determine how much Federal income tax to withhold for you.

Tax Form W-4 includes worksheets to help you determine the number of withholding allowances you can claim. These worksheets are for your purposes only – do not give them to your employer.

RELATED: Understanding Payroll and Withholding Taxes

What Happens If You Don’t Withhold Enough Tax?

If you have too much tax withheld from your wages during the year, you will receive the overpayment as a tax refund after you file your return. But if you withhold too little, you may have to make Estimated Tax payments or be subject to an underpayment penalty.

Estimated Tax

If you don’t have any tax withheld from your pay (or you don’t pay enough tax through withholding), you may be required to pay estimated tax. Generally, estimated tax must be paid quarterly in four equal installments. For more information, see “What Is Estimated Tax & Who Does It Apply To?”

Underpayment Penalty

If you don’t pay enough tax, either through withholding or estimated tax payments, you may be subject to a penalty for underpayment. According to the IRS, you could owe a penalty if your total payments (from withholding and estimated tax) do not equal at least 90% of your tax liability for the year, or 100% of your prior year tax, whichever is less.

For more information, refer to IRS Publication 505 (Tax Withholding and Estimated Tax).