Key Takeaways

- The Earned Income Tax Credit (ETIC) is a refundable tax break created for the benefit of low- to moderate-income workers and their families.

- First of all, to qualify for the EITC your income must be above $1 and below a certain cap. For 2024, that cap is at $11,600, and will go up to $11,950 for 2025.

- The value of the credit goes up with the number of children you have but caps out at three children.

- Contrary to popular belief, having children is not a requirement to qualify for the EITC. A childless, unmarried taxpayer filing as single can still apply for it.

- Not just any child will make the value of the ETIC go up, they still have to be considered “qualifying children” by the IRS.

For taxpayers who are low- to moderate income workers, the earned income tax credit (EITC) can be a highly valuable tax break that is very much worth knowing. It’s not too hard to qualify for it, either, allowing for many Americans to be able to keep more of their hard-earned money. But, who gets earned income credit?

The EITC — also referred to as the “earned income credit” for short — is also a refundable tax credit. This means that if you qualify for it, you can lower your taxes by whatever credit amount you’re eligible for.

But what really is the EITC and how can you qualify for it? This guide will help you understand all the details of this credit and take you step-by-step on how to qualify for it.

What Is The Earned Income Credit (EITC)?

The earned income credit is a refundable tax break created for the benefit of low- to moderate-income workers and their families. The reason why it’s considered such a prized option is because, as a refundable credit, it can lower your taxes significantly by an amount corresponding to the credit’s value. It can even get you money back.

Qualifying for the earned income credit seems simple at first glance since you must earn an income of at least $1 but your total income has to be below a certain amount, and that includes your investment income as well. While it might not be easy to understand right away if you qualify for this credit, it could very much be worth the effort to do so, so try getting someone with tax expertise to help you for this one.

To help you out, we will detail the process of finding out if you’re eligible step-by-step in the following sections.

How Does The Earned Income Credit Work?

As we mentioned above, first you need to earn more than a single dollar as income, but also stay below a certain threshold for your total income. Also, it’s not required for you to have children in order to claim this credit, but the credit amount will be higher if you have 1 or more children.

This credit has a hard limit on your adjusted gross income (AGI) and earned income for the year, so you will not qualify if you earn a single dollar over that amount ($11,950 for the 2024 tax year). Remember that your earned income is more than your wages or salary, it also includes tips, in kind pay by your employer, and all types of self-employment and gig work income.

Other factors that can affect the credit amount are how many children you have; the credit will grow the more children you have, but will cap out at the third child. Finally, your filing status is also taken into account to calculate the credit amount.

How To Qualify For The Earned Income Tax Credit

There are some basic rules outlined by the IRS that you must follow in order to be eligible for the EITC.

Income Requirements

First of all, you must have earned income for the current tax year, but the AGI has to be below a threshold set by the IRS (consult the following section for the detailed amounts). You are allowed to have some investment income, but it must not surpass the limit set by the IRS.

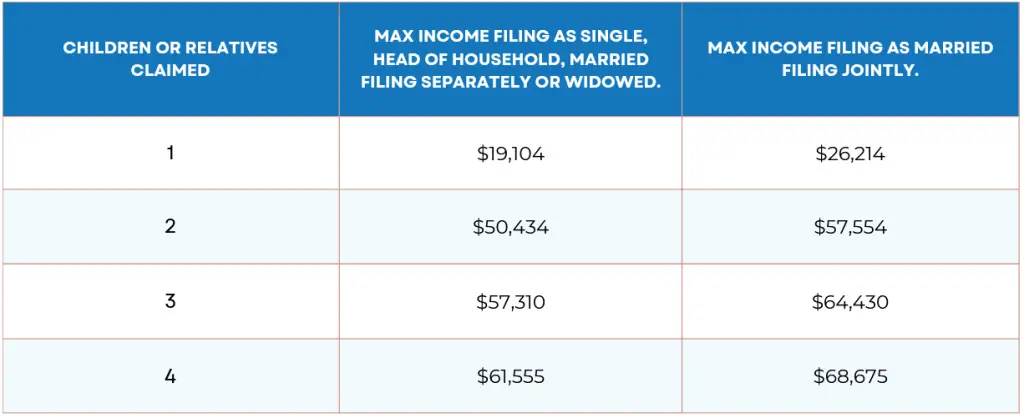

It’s important to note that there is a significant difference in the credit amounts you can get depending on your marital status and the number of qualifying children you report. While the credit amount grows and the income cap gets higher the more children you have, the credit also phases out after the third child. Also, as you can imagine, a married couple filing jointly will get a higher credit than a single filer or a head of household.

Age Requirements

You can claim the EITC at any age if you have a qualifying child. However, if you don’t have at least one qualifying child, you can only claim this credit if you are between the ages of 25 and 65. For married couples of domestic partners claiming jointly, only one of the claimants needs to be between 25 and 65 years of age.

Residency And Citizenship Requirements

To qualify for the EITC, you must be either a legal resident of the U.S.or a resident alien through the entire year. You must also, of course, have a valid Social Security number (SSN).

There are additional requirements you must meet if you are separated from your spouse and are not filling a joint tax return.

Investment Income Cap And Foreign Earned Income

Like we mentioned before, you are allowed to have earned investment income for the current year, but there is a hard cap to it. For 2024, that cap is at $11,600, and will go up to $11,950 for 2025. If your investment income goes above that threshold, you are automatically disqualified from claiming the EITC.

Finally, if you filed Form 2555 for Foreign Earned Income you will not be eligible for the EITC. According to the IRS definition, it doesn’t matter where or how you are paid, it will still be considered foreign-earned income.

How Marital Status Affects The EITC

You can claim the EITC if your filing status is single, head of household, married filing separately, and married filing jointly. While the credit amount will go up or down depending on your filing status, none of them actually prevent you from qualifying for it.

Things can get more complicated for couples who are separated but still married. For starters, they cannot both claim the EITC; to do so they must file as married filing jointly. Then, only the parent who has custody of the child can claim the EITC by filing as “head of household”, but to do so they must meet the following requirements:

- You must have lived apart from your spouse for at least six months of the tax year at the moment of filing.

- The qualifying child has to have lived with you for more than half the year.

- As head of household, you must have paid over half the cost of maintaining the household.

- Of course, the child must be a qualifying child to claim as a dependent.

Types Of Earned Income

According to IRS rules, the following types of income are recognized and will add up to your total and adjusted gross income.

- Wages, salary, or tips from which federal income taxes are withheld.

- Income from gig economy work (from which employers don’t withhold any amount for tax purposes), such as those from online apps or platforms.

- Money from self-employment, whether from a business or farm, as a member of a religious order, or as an independent contractor (AKA statutory employees).

- Benefits from a union strike.

- Disability benefits acquired before reaching the minimum retirement age.

- Nontaxable combat pay.

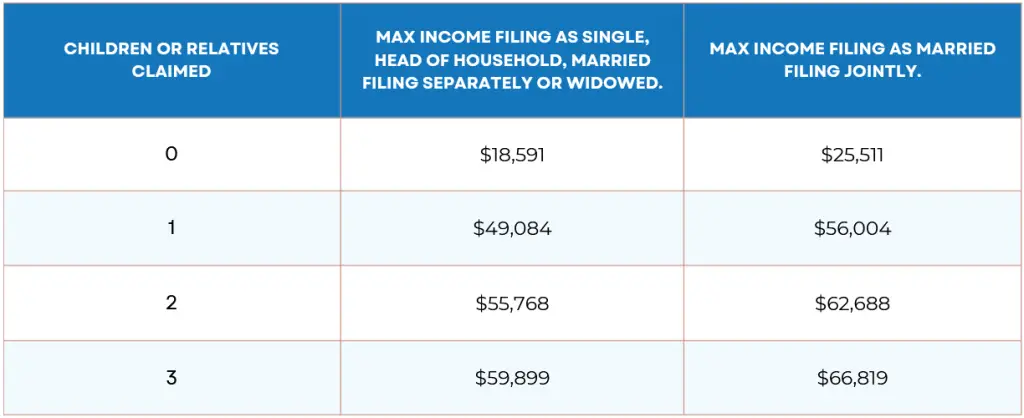

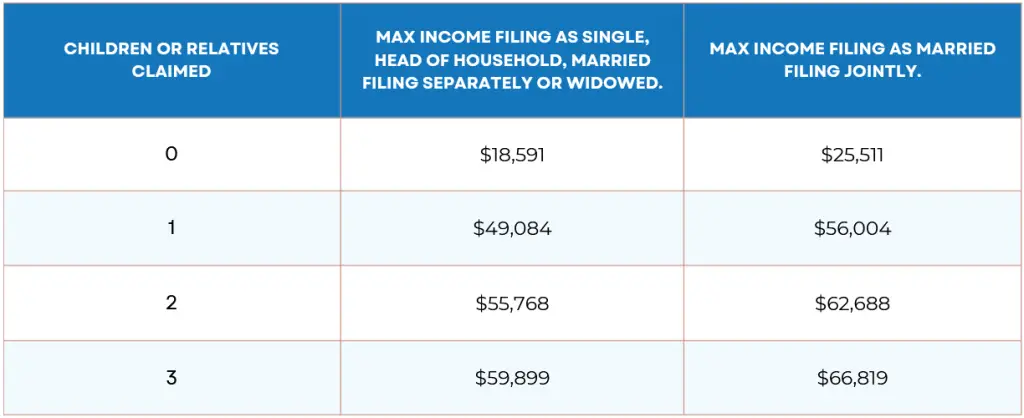

Earned Income Credit Amounts For 2024

The following table outlines the maximum earned income credit amounts, which vary depending on your filing status and how many children you have. For 2024, the maximum EITC credit amounts are $632 if you don’t have children, $4,213 if you have one, $6,960 for two children, and finally $7,830 for three children. Remember that the credit phases out after accounting for the third children.

Source: Earned income and Earned Income Tax Credit (EITC) tables.

Investment income limit: $11,600 or less.

Maximum credit amounts based on number of children:

- No qualifying children: $632

- 1 qualifying child: $4,213

- 2 qualifying children: $6,960

- 3 or more qualifying children: $7,830

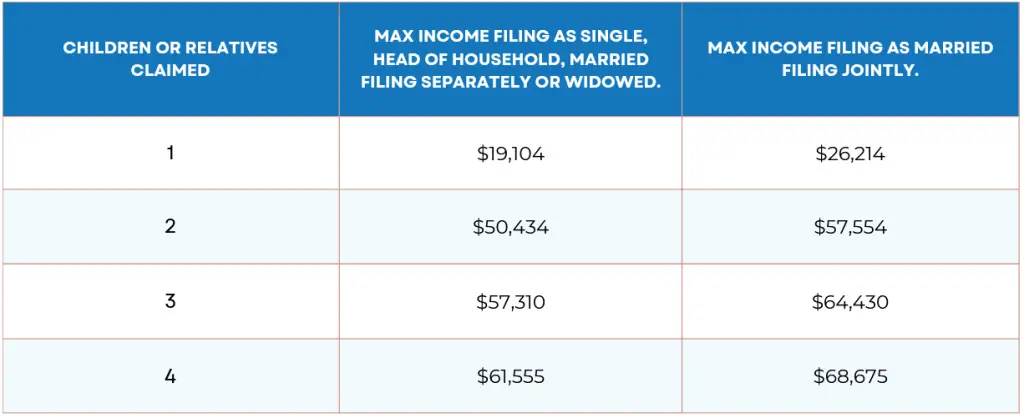

Earned Credit Amounts For 2025

Source: Earned income and Earned Income Tax Credit (EITC) tables.

Investment income limit: $11,950 or less.

Maximum credit amounts based on number of children:

- No qualifying children: $649

- 1 qualifying child: $4,328

- 2 qualifying children: $7,152

- 3 or more qualifying children: $8,046

How To Claim The Earned Income Credit

There are a few steps you must take in order to claim the earned income tax credit. First and foremost, you have to qualify for the credit by meeting certain criteria (which we describe in the previous sections of this article), and then file a federal tax return.

What Forms To File For The EITC

It all begins with Form 1040, U.S. Individual Income Tax Return, or Form 1040-SR for seniors. Then, if you’re trying to claim the credit and you have a qualifying child, file the Schedule EIC (Form 1040 or 1040-SR) along with it. Remember that you can claim the EITC even if you’re filing as a single taxpayer, and that the Schedule EIC is only for people who can claim a qualifying child or more.

Other Necessary Documents To Claim The Earned Income Credit

These are the documents you will need to validate your claim to the Earned Income Credit, and the IRS will likely request that you produce these documents to check against your application, especially if it’s your first time.

- Social Security cards and an SSn verification letter.

- Birth dates and other U.S. government identifications for everyone listed on your return.

- Copies of your federal and state tax returns.

- Every relevant expense record, such as tuition payments, real estate taxes, etc. You will also be asked to produce records of expenses if you own a business.

- All income statements such as Form W-2 and Form 1099 or Social Security and unemployment benefits, as well any benefits you’ve gained from pensions, stocks, etc. All income from businesses you own should also be reported.

- If you’ve claimed a qualifying child as a dependent and pay for their child care, you have to provide the name, address, SSn, and tax identification numbers from their caretakers.

- You also have to submit Form 1095-A if you purchased healthcare coverage through the Health Insurance Marketplace.

- Of course, you must also provide the IRS with your bank routing and account numbers in order to receive your refund through direct deposit.

When You Will Receive The EITC

If you were successful in your EITC application, you filed early in the tax season, and there were no delays, you should be receiving the credit amount you qualified by mid-February. This is done on purpose as an anti-fraud measure by the Path Act, which essentially delays the refund of all early filings to prevent identity theft.

According to the IRS website, you can expect your EITC by February 27 if you:

- File your return online.

- Selected the option to get the refund by direct deposit.

- There were no issues detected by the IRS with your return.

Common Mistakes To Avoid When Claiming The EITC

As with any other tax credit, making a mistake when claiming the EITC will delay your tax report and open you up to penalties and, worst case scenario, loss of eligibility in the future. The following is a list of the most common errors made by taxpayers when filing for the earned income credit and what you can do to avoid them.

Misreporting Your Income

It should go without saying, but over or underreporting your earned income is a big hurdle when claiming an “earned income credit”. To avoid any problems when trying to claim the EITC, make sure to keep accurate records of every single income source you have, whether you’re an employee or self-employed. After you’ve filled in your W-2 and/or 1099 forms, take a minute to cross-check the income details with your application.

Reporting money sources that are not considered earned income by the IRS is also a common mistake; remember that things such as Social Security, child support payments, and unemployment benefits don’t count towards your earned income for the EITC.

Claiming Unqualified Dependents

When trying to claim the earned income credit, keep in mind that not just any child can be a “qualifying child”, since they have to meet the criteria outlined by the IRS. The relationship test checks how you and the child are related (whether they are a child, stepchild, foster child, sibling, or descendant of any of those); the age test checks whether the qualifying child is between the ages of 19 and 24 for full time students (they can be any age if they’re permanently disabled); finally, the residency test makes sure the child has lived with you in the U.S. for over six months.

Thankfully, there is an official IRS EITC Assistant online tool to help you sort through these different tests and confirm if your child is eligible as a qualifying child for tax credit purposes.

Not Applying For The EITC Because You Are A Childless Worker

A great amount of taxpayers believe that, since they don’t have children, they are automatically ineligible to claim the earned income tax credit. This is actually a very common mistake since the credit is so well known as a helping hand for working families with children, but as long as you meet the age, income and residency requirements, you can definitely apply for the EITC as a childless worker (even if the credit amount will be smaller).

Neglecting To Respond To IRS Notices

Just because you qualify for the EITC on paper doesn’t mean that applying for the credit is a done deal. Even if you meet all the relevant criteria, the IRS can still send inquiries or request additional documentation to review your application against; failure to respond to these notifications will only cause processing delays and might even get you penalized, so make sure to pay attention when checking your mail or inbox, and be ready to provide all the proof that’s requested of you (most commonly you will be asked to produce evidence of your relationship with the qualifying child).

Who Gets Earned Income Credit?: FAQ

1. How many times can I claim the EITC?

You can claim the earned income credit every year that you qualify for it.

2. When can I claim the earned income credit?

If you meet the qualifying criteria for the EITC, you can claim it when filing your annual tax return with the 1040 Form.

3. How much is the EITC worth?

There is no set value for the earned income credit. The amount you can claim from it is calculated with your adjusted gross income and grows with each qualifying child you have as dependents. You can also ask the IRS to calculate it for you through your tax return.

4. Is the Earned Income Tax Credit only for married couples with children?

No, you can still qualify for the EITC if you apply as a childless worker and meet the age, income, and residency requirements outlined by the IRS.

5. What does “earned income” mean?

For tax purposes, and particularly for the EITC, “earned income” refers to any taxable wages, salaries, and any other type of taxable earnings made through employment or self-employment. The IRS outlines all types of income they consider to be taxable “earned income”, as well as nontaxable income that doesn’t count towards your total earned income.

6. Will the money I get from refunds after claiming the EITC affect my government benefits?

Any amount of money refunded to you from your federal income tax return will (generally) not count as income, therefore you will still be eligible for benefits or assistance. The amount will also not affect how much you can get from federal or state programs.

Nick Charveron

Nick Charveron is a licensed tax practitioner and Partner & Co-Founder of Community Tax, LLC. As an Enrolled Agent, the highest tax credential issued by the U.S. Department of Treasury, Nick has unrestricted practice rights before the IRS. He earned his Bachelor of Science from Southern Illinois University while serving with the U.S. Army Illinois National Guard and interning at the U.S. Embassy in Warsaw, Poland. Based in Chicago, Nick combines his passion for finance and real estate with expertise in tax and accounting to help clients navigate complex financial challenges.