Tools & Forms

How Can You File Taxes Without a W-2 Form? It’s Possible, and Here’s How to Do Your Taxes Without a W-2

So the ol' "Dog ate my W-2" excuse won't work? Filing your taxes can be a daunting task, especially when you do not have all…

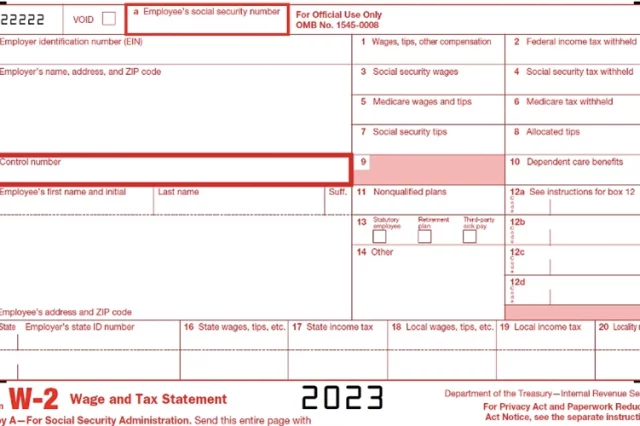

Big Questions, Small Form: What’s Box-D on Form W-2? Where Is It, What’s It for, and Can It Be Left Blank?

Is there a name for hypochondria about your tax forms? I've wondered about Box D on W-2, but now, I don't! Box D on Form…

Tax Teamwork: Instructions for Partnerships Using Form 1065 on Their Federal Tax Returns

They say partnership is hard. Then comes along Form 1065. Before diving into the details of 1065 instructions, it’s important to understand the context behind…

How a 1099 Tax Calculator Adds Up to Big Savings for Contractors and Self-Employed Individuals

What is a 1099 Tax Calculator? If you're a freelancer, independent contractor, or vendor who isn't on an employer's payroll, you may receive a 1099…

You Received a 5071C Letter. Now What?

What's the Purpose of the 5071C Letter? IRS Letter 5071C serves a crucial purpose in protecting taxpayers from potential tax fraud. In short, the IRS…

What Business Owners and Employers Should Do When The IRS Gives Them a 147c Letter

Understanding Your Specific IRS Letter 147c IRS Letter 147c is an official form of verification issued by the IRS (Internal Revenue Service) that confirms the…

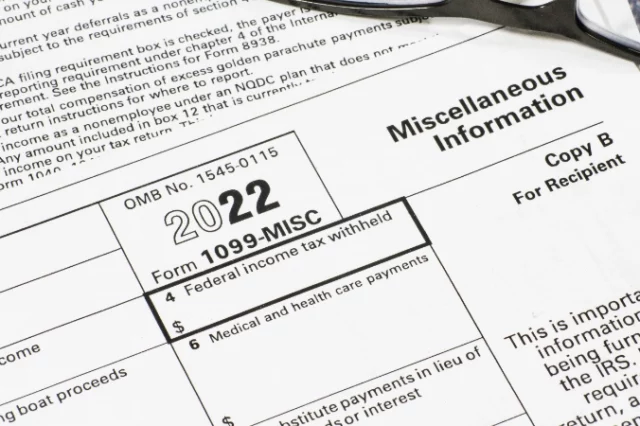

Rejoice, Employers! You Can File Your 1099 Tax Forms Online

The miracle of the Internet Age meets business tax compliance. Form 1099-MISC is an IRS tax form used to report miscellaneous payments made to independent…

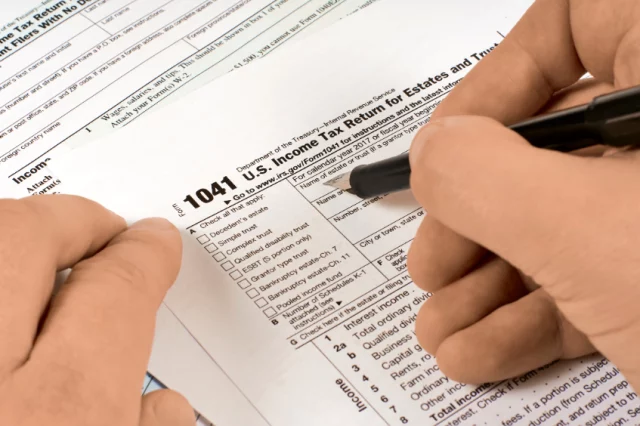

The Trusty Guide to Form 1041 for Estates and Trusts

Form 1041 is an IRS income tax form that is used to report and pay income taxes on behalf of a trust or estate. It…