Tools & Forms

Can You Get an Additional Tax Return Extension?

[video width="1280" height="720" mp4="https://www.irs.com/wp-content/uploads/2025/03/Understanding_Tax_Return_Extensions.mp4"][/video] It goes something like this: Tax season was fast approaching and you just knew you weren’t going to make the…

Lost IRS Refund Check

Your tax refund is missing. What do you do? First, check the IRS’ “Where's My Refund” online tool to make sure that your tax refund…

Life Events That Can Impact Your Taxes

A change in life circumstances, whether good or bad, can affect your tax return. >> Start Your FREE E-file Here are some instances where you will…

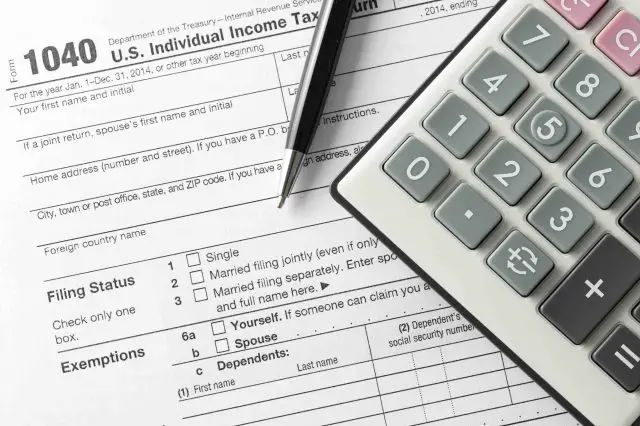

Do You Need a Copy of a Past Tax Return?

Tax Return Copies & TranscriptsWhen applying for a loan or other financial assistance, you will likely be asked to provide copies of your tax returns…

Tax Tips To Report Your Hobby Income

[video width="1280" height="720" mp4="https://www.irs.com/wp-content/uploads/2025/03/hobby.mp4"][/video] Is your favorite pastime classified as a business or a hobby? Here’s how the IRS sees it. Millions of people enjoy…