Tools & Forms

Tax Preparation Tips for Your 2020 Return

Your 2021 Tax Guide for Filing a Return, Paying Taxes, & COVID-Related Tax Relief This past year has brought many changes for individuals, families, and…

How To Determine Your Income Tax Bracket

Federal Income Tax Brackets, Rates, and Filing Statuses In order to properly file your federal income tax return and pay any tax that you owe, it is…

IRS Announces Extended Deadlines and New Legislation in Response to the Coronavirus Outbreak

IRS Unveils “People First Initiative” and COVID-19 Effort Adjustments; Extends Due Dates, Postpones Compliance Programs The Internal Revenue Service has announced a series of steps…

Apply for a Tax ID (EIN) Number for a Personal Service Corporation | Online EIN Application

Trying to get a Personal Service Corporation Tax ID Number? You will likely need an official Tax ID in order to efficiently run your personal…

Apply for a Church Tax ID (EIN) Number | How to Apply Online

Trying to get a Church Tax ID Number? You will likely need an official Tax ID in order to run your non-profit organization. Learn how…

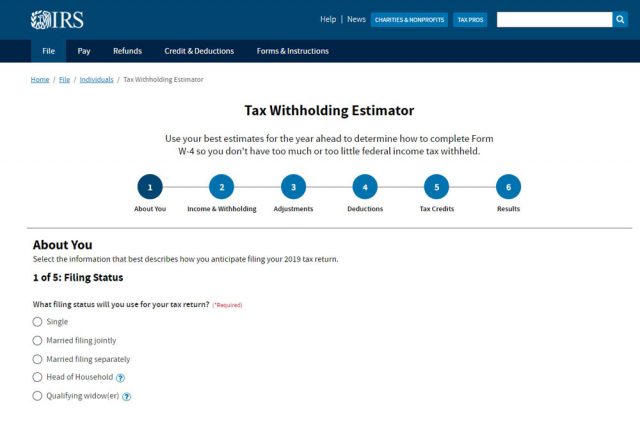

IRS Tax Withholding Estimator

What are Tax Withholdings? Tax withholdings are the portion of your wages held from your paychecks by your employer. They are determined based on your…