Tools & Forms

1095-A vs 1095-C: A Healthy Understanding of Tax Forms about Health Insurance

The Purpose of the 1095 Forms These two forms I love scrambling for because I'm still not used to sticking them with my W-2s: The…

Form 1040: The Flagship Form of the IRS

What Is Form 1040? Form 1040 is the flagship form of the Internal Revenue Service (IRS). It is used to report an individual's income and…

Your 411 on Tax Code 150: Transcripts, Codes and More

[video width="1280" height="720" mp4="https://www.irs.com/wp-content/uploads/2023/04/Understanding_IRS_Tax_Code_150.mp4"][/video] Tax Code 150 "Tax Return Filed" is a code used by the Internal Revenue Service (IRS) to identify transactions related to…

Form 8919 Helps You Patch Up Social Security and Medicare Payments

What is Form 8919? Form 8919 is a form issued by the Internal Revenue Service (IRS) to help individuals who were treated as independent contractors…

Making Common Sense of Form 8858

Form 8858 is a form used by taxpayers that own foreign entities and are required to report income from these entities on their U.S. tax…

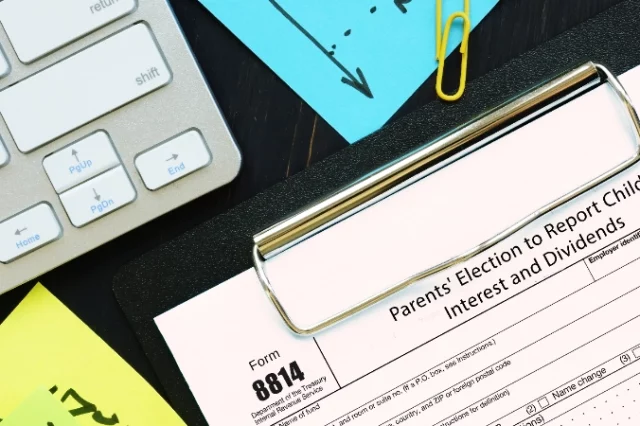

Reporting your Child’s Capital Gains and Dividends on Your Taxes: Form 8814

Are you the parent of a full-time student and unsure of your tax filing requirements? Form 8814, Parent's Election to Report Child's Interest and Dividends,…

Form 8805: When Your Business is Earning with Earning Foreign Partners

If you’ve ever had income from a partnership with foreign partners involved, there’s a good chance you’ve either come across Form 8805 or you will…

Form 8275: Adjusting or Correcting Your Return

When you want to tell the IRS so much more than what's on their usual forms, there's Form 8275. Filing taxes can be a daunting…