Tax Deductions

Tax Preparation Tips for Filing Your 2021 Return in 2022

Get Ready to File Your 2021 Federal Tax Return By April 18, 2022 The 2022 tax filing season us coming up, so it’s time to…

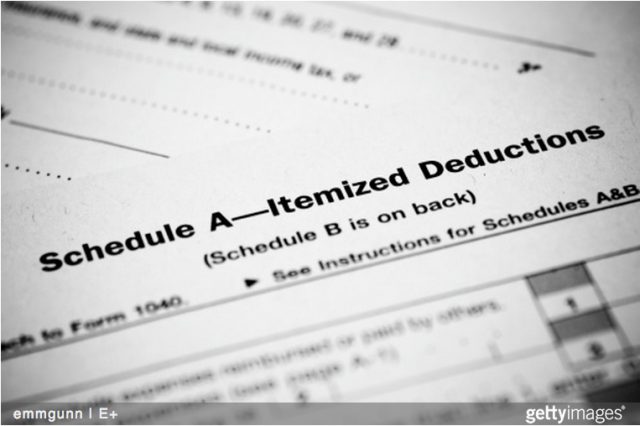

Should You Itemize Your Deductions?

Tax Tips for Claiming Itemizing Deductions vs. the Standard Deduction When you are filing your 1040 tax return, right before you compute your final taxable income, you…

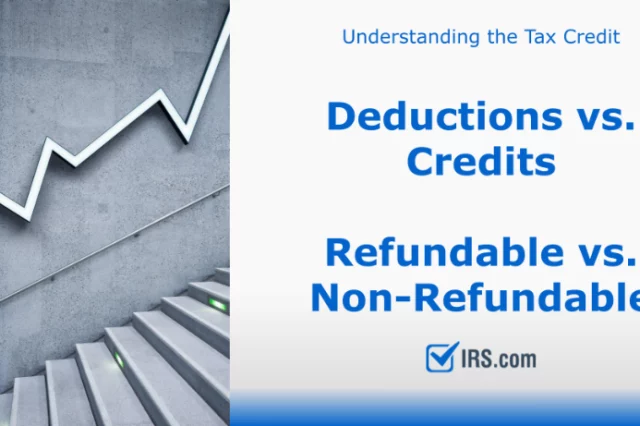

The Standard Tax Deduction: 6 Key Points To Know

[video width="1280" height="720" mp4="https://www.irs.com/wp-content/uploads/2021/12/Understanding_Standard_Tax_Deductions.mp4"][/video] Claim the Standard Tax Deduction on Your 1040 Return to Lower Your Income Tax Liability Are you going to take the…

Which Tax Form Should You File?

Federal Tax Returns Have Undergone Several Changes Over the Past Few Years There used to be several different versions of the federal individual income tax…

Tax Filing Season Begins February 12

Tax Tips & Information for Filing Your 2020 Income Tax Return The IRS announced that the 2021 tax filing season will begin on Friday, February…

How to File Your Federal Income Tax Return

Tax Tips and Steps for Filing Taxes With the IRS: Form 1040 or Form 1040-SR If you are living and/or working in the United States,…