Job and Business

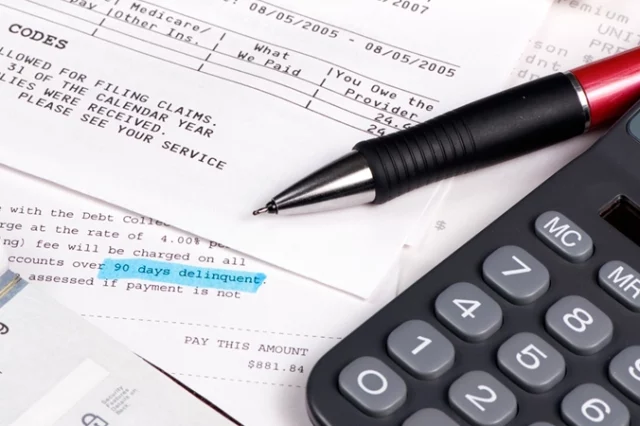

Temporary employee and independent contractor tax issues

How do temp employees file their taxes, and how do you know when you are an independent contractor? The economy might be improving, but…

How to know if your small business qualifies for the “small seller exception” in Marketplace Fairness

Here's what to do if it passes. If passed, as is, the Marketplace Fairness Act will exempt small sellers from state sales tax. I take…

Small business owners favor tax reform to reduce complexity

Complexity and inconsistency within the tax code continue to be major issues for small business owners. According to a survey conducted by the National Small…

Why is my SECA Tax more than my friend’s FICA Tax?

What is SECA, why I pay more for Social Security, and how is that even fair You may have noticed the remarkably high self-employment…

Small business structures for couples

What are the differences, and which is better for your small business? Elsa and Bill are recently married and considering whether to ‘marry’ their…