Education

What Is Federal Withholding

How These Taxes Affect Your Paycheck, Tax Return, and Tax Refund The terms “payroll taxes” and “withholding taxes” essentially refer to the same thing. In…

Tax Credits

What Are Tax Credits & How Do They Lower Your Tax Bill? Tax credits can help reduce your liability dollar-for-dollar. That being said, they generally…

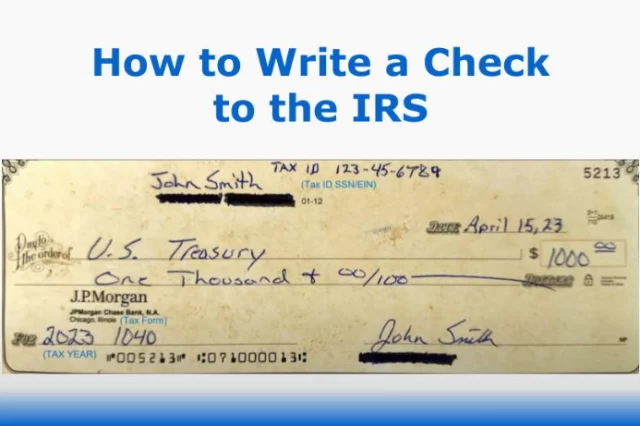

Every Tax Payment Method You Can Use

[video width="1280" height="720" mp4="https://www.irs.com/wp-content/uploads/2025/03/Top_6_IRS_Payment_Methods.mp4"][/video] Can I pay my taxes online? That’s a question that we run into all the time. Individuals have many…

What federal income tax form do I file to deduct education expenses?

Certain education expenses can be claimed on your 2010 federal tax forms to lower your tax liability. These expenses are claimed on your 1040 tax…

The Hope Credit: Where It Went And What Replaced It

[video width="1280" height="720" mp4="https://www.irs.com/wp-content/uploads/2010/08/Transition_from_Hope_to_AOTC.mp4"][/video] As anyone that’s ever been to college can attest to, higher education can be prohibitively expensive in the U.S. These…

AOTC: What Is The American Opportunity Tax Credit?

[video width="1280" height="720" mp4="https://www.irs.com/wp-content/uploads/2010/08/Untitled_video1.mp4"][/video] Higher education is a worthy pursuit, but it’s also way too costly for most Americans. The American Opportunity Credit (AOTC) can…

Education Tax Credits

It used to be that parents spent a lot of time worrying about how they were going to be able to afford to send their…

Tax Credits

Lower Your Taxes By Claiming Tax Credits On Form 1040 Ask anyone and they will surely tell you they pay too much in taxes. Fortunately,…