Key Takeaways

- Saves You Time and Stress: Hiring a professional tax preparer means tapping into their expertise, which can save you hours of stress and confusion. They’re familiar with the latest tax laws, deductions, and credits that you might miss if you’re doing your taxes solo. This is especially helpful if you have a complex financial situation with multiple income streams, investments, or business expenses.

- Bigger Refunds, Lower Tax Bills: Professionals know the ins and outs of the tax code, which means they can often identify deductions and credits you might overlook. This could result in a larger refund or a smaller tax bill. Their knowledge ensures you're not leaving money on the table due to missed opportunities.

- Comes with a Cost: Professional tax preparation isn’t free. Fees can range from $150 to $400 or more, depending on the complexity of your return. While the cost might be worth it for those with intricate tax situations, it can feel like an unnecessary expense if your taxes are straightforward.

- Lower Risk of Errors: Tax professionals are trained to avoid common mistakes like math errors, incorrect deductions, or missed credits. They also double-check your return before filing, reducing the risk of audits or penalties. However, no system is foolproof, so it’s still wise to review your return before submission.

- Limited Control: If someone else handles your taxes, you might not fully understand the details of your own financial situation. This can be a disadvantage if you prefer having control over your finances or if you want to learn more about the tax process. Additionally, not all tax preparers are equally qualified, so it's essential to choose wisely.

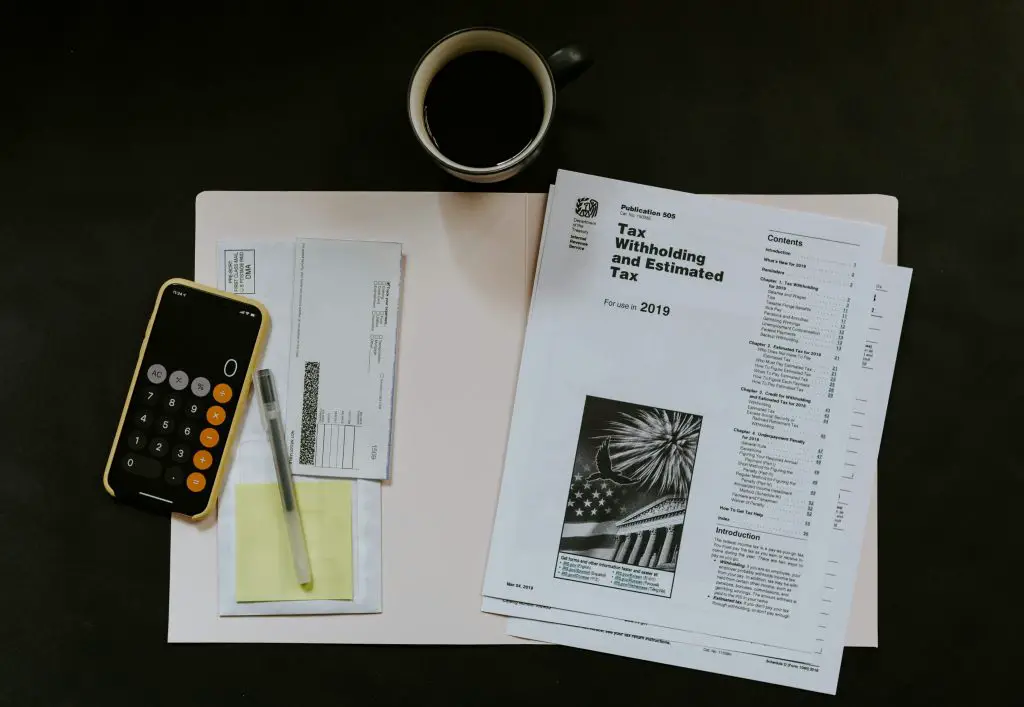

Millions of Americans ask themselves the same question every year: Should I just pay a tax professional? A tax preparation service can be a fantastic help, but there are some things you need to keep in mind when doing so. This guide will help you remember them!

One of the most important decisions you can make regarding your income taxes is whether to get your tax preparation done with the help of a professional, versus trying to go it alone or using self-guided tax preparation software.

This article discusses the pros and cons of getting a professional tax preparer to handle things for you. Let’s start with a con, because it’s important to talk about it before anything else.

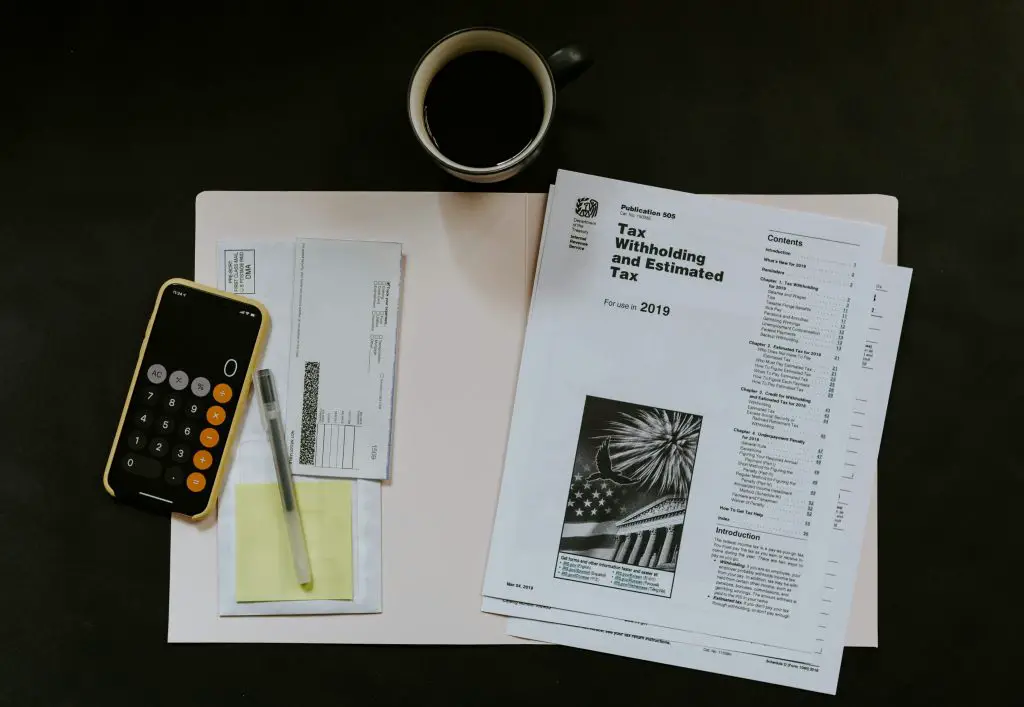

CON: The Initial Cost of a Tax Professional Can Be Unappealing

The most obvious drawback to hiring a tax professional who will personally prepare and file your return is the cost. The price for getting your tax return prepared by a professional may range anywhere from $60 to $1,000 or more, depending on the type and number of tax form(s) you need filed.

If your tax situation is relatively complicated, you should expect to pay more for professional tax preparation. You’ll also pay more if you’re filing taxes with your state, too.

A survey by the National Society of Accountants (NSA) showed that the average cost of professional tax preparation is $246 (though it varies depending on service). This is the price that most tax preparers will charge for a 1040 Tax Form with itemized deductions (Schedule A) plus a state tax return.

On the other hand, the cost of getting a simple 1040 Form (without itemized deductions) prepared by a professional averages around $143. As for business tax returns, the NSA survey found that the average cost for preparing an 1120 Tax Form (corporations) is $759, while the average cost for preparing an 1120S Tax Form (S corporations) is $717.

PRO: A Tax Professional Can Help You Save Time and Money

If you’re juggling multiple sources of income and wanting to minimize your tax liability, you might find a serious financial incentive if a professional can help you take advantage of deductions you might have missed.

There’s a reason a whole profession devotes its time to studying the tax code. Financial situations can be complex, and the tax regulations and rules change each year.

Some of the most significant benefits of shelling out for professional tax preparation are convenience and accuracy. Think about the hours you could save yourself from trying to read through and understand the IRS’s form instructions, publications, and news releases.

If you put a monetary value on your time, you might find that the hours you spend laboring over your tax return ends up costing you more than the services of a tax professional. Along with time, how much do you value your peace of mind? Costly mistakes can make hiring a professional worth every penny.

The risk of error when filing tax forms can be daunting, but you can minimize that by hiring a tax professional. A professional tax preparer can also help you avoid overpaying taxes by properly identifying all the tax credits and tax deductions you’re eligible for.

For those who don’t want to spend the money on a tax professional but don’t want to go it alone, purchasing tax preparation software is often a good middle ground.

However, you should keep in mind that a tax preparation software program cannot always ask you the right questions about your particular circumstances (such as your capital gains and losses).

This is because the majority of tax preparation software is designed for individuals with simpler tax situations, and is not well-suited for taxpayers with complex finances.

Additionally, tax preparation software programs do not provide you with the guarantee of representation against a potential tax audit, a benefit included with most professional tax preparation.

CON: There Are Many Scams. Be Careful About Hiring the Right Tax Professional

Speaking of cons, there are several things you should consider when employing the services of a tax professional.

For one thing, you don’t wait until the last minute to schedule an appointment. The best accountants in your area will likely have waiting lists that fill up by January or February.

You will not have many options regarding professional tax preparation if you attempt to contact someone a few days before your return is due (typically April 15th), although online tax preparation software will still be available. Tax season is busy, and the month of April might be one of the busiest times to try picking a professional tax preparer.

If you do decide on professional tax preparation, make sure to check the tax professional’s references, just as you would before taking on any type of employee.

Ask friends and family for recommendations, and remember that testimonials and reviews by satisfied customers are a good indicator. You will want to keep your eye out for any business whose license is no longer valid with the IRS.

PRO: Your May Be Able to Deduct The Cost of Tax Preparation Fees

Let’s get back to those professional tax preparer fees. Fees associated with professional tax preparation may be deductible on your income tax return as long as you meet certain eligibility requirements. Tax preparation fees are considered a miscellaneous deduction. They’re under the itemized deductions on IRS Tax Form 1040 Schedule A.

For instance, the mileage you drove to your tax preparer, the postage you paid to mail documents to your tax preparer, and the postage you paid to mail your tax return to the IRS and state tax agency – that’s all deductible. Did you buy a book on the ever-changing tax laws to help you file your return? Then you may be able to deduct that book’s cost.

In some cases, tax preparation software programs (where a tax accountant/preparer is not involved) can be tax-deductible. Additionally, if you paid a fee to e-file your tax return online , you may be able to deduct that expense.

It is important to remember that tax preparation fees are categorized as a miscellaneous deduction. If you don’t itemize your deductions, you can’t claim this tax break. Also note that your miscellaneous deductions must exceed 2% of your adjusted gross income (AGI) before they can start being counted against your taxes.

Pros and Cons of Professional Tax Preparation: FAQ

1. Is professional tax preparation worth the cost?

It depends on your financial situation. If you have a simple tax return with few deductions, you might not need a professional. However, if your finances are complex—think investments, self-employment income, rental properties, or significant deductions—a professional can save you time, reduce stress, and potentially lower your tax liability, making the cost worthwhile.

2. How do I know if I need a professional tax preparer?

Consider hiring a professional if you have multiple income streams or own a business, are dealing with major life changes (e.g., marriage, divorce, new home), have investments or rental income, or want to maximize deductions and credits. If your tax situation is straightforward, DIY software might be sufficient.

3. Are all tax preparers equally qualified?

No. There are different types of tax preparers, including Certified Public Accountants (CPAs), Enrolled Agents (EAs), and seasonal tax preparers. CPAs and EAs have extensive training and certifications, while seasonal preparers might have less experience. Always verify a preparer’s credentials and ask about their qualifications before hiring.

4. Can a tax professional help me if I’m audited?

Yes, but the level of assistance depends on their credentials. CPAs, EAs, and tax attorneys can represent you before the IRS during an audit. Other tax preparers might offer limited support, so it’s wise to choose someone who can handle audit situations if necessary.

5. What are the risks of hiring a tax professional?

While professionals reduce the risk of errors, no one is perfect. There’s also the risk of hiring an unqualified or unethical preparer. Minimize risks by checking for credentials and reviews, ensuring they sign your return (don’t overlook this, since it’s a legal requirement), and by avoiding preparers who promise unusually large refunds.

6. Can I still be responsible for errors if a professional prepares my taxes?

Yes. Even if a professional prepares your return, you are ultimately responsible for its accuracy. That’s why it’s important to review your return before it’s filed. If errors lead to an audit or penalties, you could still be held liable, although some preparers offer guarantees or assistance in case of mistakes.

Jacob Dayan

Entrepreneur • CEO Community Tax, LLC

Jacob Dayan is the CEO and co-founder of Community Tax LLC, a leading tax resolution company known for its exceptional customer service and industry recognition. With a Bachelor’s degree in Business Administration from the University of Michigan’s Ross School of Business, Jacob began his career as a financial analyst and trader at Bear Stearns and Millennium Partners before transitioning to entrepreneurship. Since 2010, he has led Community Tax, assembling a team of skilled attorneys, CPAs, and enrolled agents to assist individuals and businesses with tax resolution, preparation, bookkeeping, and accounting. A licensed attorney in Illinois and Magna Cum Laude graduate of Mitchell Hamline School of Law, Jacob is dedicated to helping clients navigate complex financial and legal challenges.