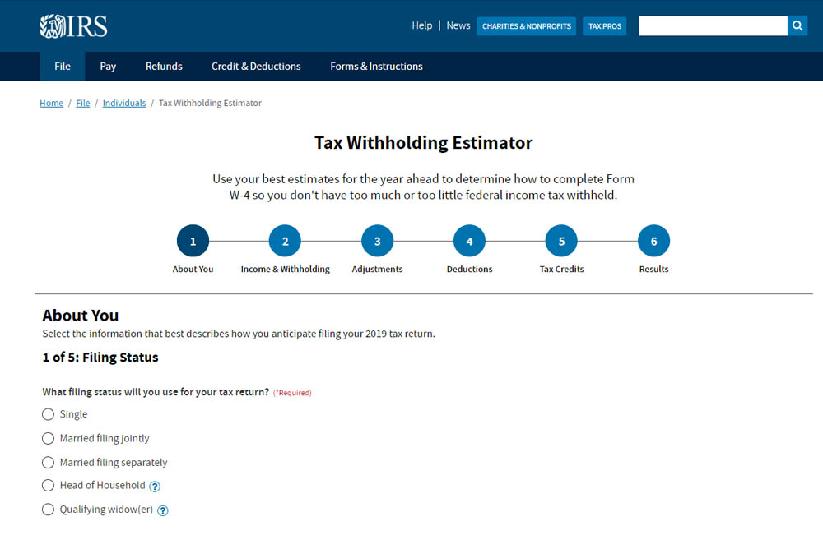

Tax Calculators

Published:Online tax calculators are helpful tools for anyone looking to compute their tax liability, estimate their tax refund, or simply better manage their finances. While most tax calculators cannot guarantee completely accurate results, they can offer useful insight into your financial situation.

There are several different kind of tax calculators available today.

The ‘Tax Refund Estimator‘ is a tax calculator that provides a fairly reliable figure for your estimated tax refund. It can help you determine if you’ve underpaid taxes for the year, and if so, how much you will owe the IRS on April 15th. If you are getting a tax refund, this calculator can also help you plan how to use those funds most appropriately.

The ‘Standard Deduction vs. Itemized Deductions‘ tax calculator can help you decide whether to take the standard deduction or itemize you deductions. Your standard deduction amount is based on your filing status, and it is subtracted from your adjusted gross income (AGI). Itemized deductions (including tax deductions for medical expenses, tax deductions for charitable contributions, and deductions for insurance premiums) are subject to limitations.

The ‘Deducting Investment Interest‘ tax calculator can help you determine how much deductible investment interest applies to your federal taxes from your investment activity. The interest paid on money used to generate income from investments is generally tax-deductible.

The ‘Capital Gains/Losses Estimator‘ is a tax calculator that simplifies the process of figuring out what your tax liability (or credit) may be from the sale of assets. When you sell an asset, the difference between the amount you originally paid for it (the cost basis) and the amount you sell it for is called a capital gain or capital loss.

The ‘Tax Implications of Paying Interest‘ tax calculator can help you understand how to deduct the interest you’ve paid on a home loan, investment account, and other personal expenses. Since interest on loans and obligations can add up to a lot, it’s important to know what you can deduct from your taxes.