What are Tax Withholdings?

Tax withholdings are the portion of your wages held from your paychecks by your employer. They are determined based on your filing status and standard deduction for the year. Federal taxes are withheld from your paychecks to cover your anticipated annual income tax liability, or what you are required to pay to a federal, state, or local government based on your current year income.

The amount of income your employer withholds from your paycheck depends on the following factors:

- How much money you earn

- What information you’ve provided to your employer on your Form W-4 (Employee’s Withholding Certificate)

For individual employees, federal income taxes are withheld from your pay by your employer and may also be held from other income, including pensions, bonuses, commissions, and gambling winnings.

For employers, taxes such as federal income tax and Social Security and Medicare Taxes are withheld.

For foreign persons receiving most types of income source in the United States, U.S. tax of 30% is generally withheld.

The percentage of taxes withheld from your paychecks can be adjusted at any time during the year by modifying your Form W-4. This is usually to make sure you have the right amount of taxes withheld. The W-4 is completed and submitted to inform your employer how much taxes they should take out of your paycheck. Depending on your Form W-4, your take-home pay can be increased or decreased. The more money withheld will give you a bigger refund at tax time or smaller tax payments due, but will mean you have less take-home pay per period. The less money withheld will mean a bigger paycheck, but a smaller tax refund or larger tax payment due to the government.

About the IRS’ Tax Withholding Estimator

Any taxpayer who has income taxes withheld from their paycheck can use the Internal Revenue Service (IRS) Tax Withholding Estimator to make changes to their federal withholdings. As of 2020, the IRS launched a new Tax Withholding Estimator to simplify the process of finding out the correct amount of tax to withhold during the year.

The old W-4 Calculator for withholdings has been replaced with the new Tax Withholding Estimator as the IRS continues to explore ways to help taxpayers have a better experience. “The new estimator takes a new approach and makes it easier for taxpayers to review their withholding,” said IRS Commissioner Chuck Rettig. “This is part of an ongoing effort by the IRS to improve quality services as we continue to pursue modernization and enhancements of our taxpayer relationships.”

In the past the tax calculators were criticized for not being able to work well with all taxpayers, and had narrow usages. This new withholding calculator compares your estimate to your current tax withholdings to help you decide if you need to make changes with your employer. It automatically calculates what parts of Social Security benefits are taxable. It also can be used by workers, people with self-employment income and people who are retirees, as a more user-friendly tool to figure the amount of income tax they must have withheld from wages and pension payments.

You can try out the new Tax Withholding Estimator on the IRS website HERE and you will need to be able to estimate your past year’s income, your number of children you will claim for the Child Tax Credit (CTC) and Earned Income Tax Credit (EITC), and other items that will affect your taxes like itemized deduction amounts. It will also be handy to have your most recent pay stubs and a copy of last year’s forms.

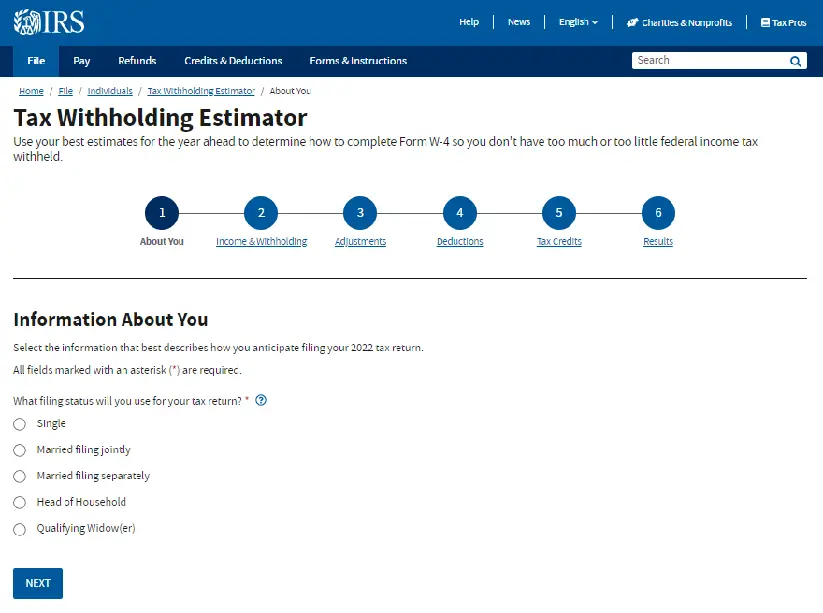

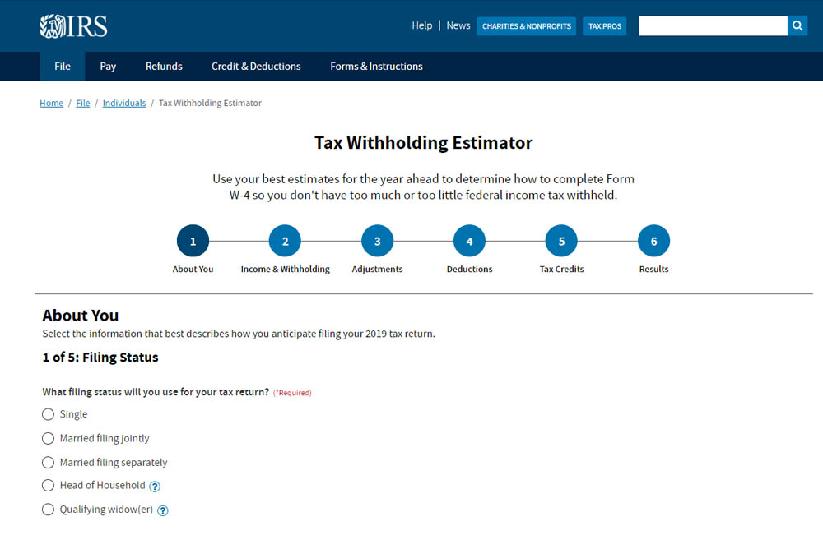

The federal tax withholding calculator is much more user friendly, and the opening screen looks like this:

How Does the Withholding Calculator Work?

By filling out the IRS Tax Withholding Estimator online tool, you can:

- Estimate your federal income tax withholding

- Determine if you should complete a new Form W-4 to modify extra withholdings

- Learn the information required on a new Form W-4.

- See how your refund, take-home pay or taxes due are affected by your current withholding amount

- Choose an estimated withholding amount that works for you

- Save time with completed worksheets generated by the tool

Prepare before using the Tax Withholding Estimator by having relevant documents. Be sure you have your most recent pay stubs (as well as those of your spouse), information for additional income from other sources (side jobs, self-employment, investments, etc.), and your most recent income tax return.

The results are as accurate as the information you enter. The withholding calculator does not save your information for security purposes, and will not ask for sensitive information such as your name, Social Security Number, address, or banking information.

Who Should and Should Not Use the Estimator?

Every individual taxpayer who works for someone else as an employee and depends on tax withholdings taken from their pay should use the estimator to make sure they can properly cover their tax obligation.

You should also use the withholding calculator if you:

- Are currently unemployed

- Are self-employed and made self-employment income

- Have non-traditional sources of income (including pension, qualified dividend income, rental houses, etc.)

- Experienced a major change to your personal situation affecting your filing status or household income (marriage, divorce, birth or adoption of a child, purchased a home, or retired)

- Are working two or more jobs at once, or take part in the gig economy

- Work only part of the year

- Claim credits such as the Child Tax Credit

- Have dependents aged 17 or older

- Itemized deductions on your past tax returns

You cannot use the estimator if you:

- Have a pension but not a job

- Have nonresident alien status

Why Should You Check Your Withholdings?

The IRS advises all taxpayers to review their withholdings every year to make sure there is not too much or too little federal income tax withheld. This can help protect against an unexpected bill, interest, or penalties in the following year. The sooner you can check your withholding, the easier it will be to determine the right amount of taxes that need to be withheld from your paychecks. Because tax situations are very diverse and can shift quickly, it’s important to make sure you are prepared.

Some important factors to note:

- If you collected unemployment compensation during the tax year, such as special unemployment compensation under the Coronavirus Aid, Relief, and Economic Security Act (CARES), it must be reported on your tax return because it is considered taxable income. This may increase your taxes owed.

- If you received unemployment checks, you may owe more tax at tax time since withholdings are not taken from unemployment income.

- If you do not pay enough withholding or estimated taxes, you may have to pay a penalty at tax time (underpayment penalty).

- Unemployment compensation is considered unearned income and does not count when calculating Earned Income Credit (EITC) to cover portions of taxes due. Your tax credits may be less based on if you received any unemployment benefits.

When Should You Check Your Withholdings?

You should check your withholdings every year using the IRS’ withholding estimator as a quick “paycheck checkup”.

It is especially encouraged to re-evaluate your withholdings when you’ve had a major life change or change in financial situation such as:

- New job or other paid work

- Major income change

- Marital status

- Divorce

- Retirement

- Child birth or adoption

- Home purchase

If you changed your tax withholding mid-year with your employer, be sure to check your tax withholding at year-end, and adjust as needed with a new Form W-4.

If you have more questions about tax withholdings, ask your employer or our partner tax advisors at Community Tax for further tax advice and information, or use the IRS Tax Withholding Estimator now to find out if you have enough withholdings to cover the taxes you will owe next year.

Sarah Nieschalk

Sarah E. Deierlein Nieschalk, EA, is an experienced tax professional with over a decade of expertise representing taxpayers before the IRS. As an Enrolled Agent and Assistant Vice President of Servicing at Community Tax, LLC, Sarah specializes in resolving complex federal and state tax collection issues, including high-dollar individual liabilities, employment tax challenges, and corporate audits. Since becoming an Enrolled Agent in 2012, she has resolved over 5,000 cases, saving millions for clients while protecting countless businesses. Outside of work, Sarah enjoys painting, staying active, and raising her family of rescued dogs while contributing to nonprofit causes through storytelling events.