What is a 1099 Tax Calculator?

If you’re a freelancer, independent contractor, or vendor who isn’t on an employer’s payroll, you may receive a 1099 form for income you earned throughout the year. While being self-employed and receiving 1099 income have some similarities, there are important differences to consider.

A 1099 tax calculator is an online tool that helps individuals estimate how much they owe in taxes based on their estimated self-employment income. Self-employed individuals or independent contractors receive Form 1099 from their clients instead of receiving a W-2 form that traditional employees receive. There are various types of 1099 forms, including 1099-MISC for miscellaneous income, 1099-DIV for dividends, and 1099-INT for interest income.

If you are a freelancer, consultant, or contractor, you may receive a 1099 form at tax time instead of a W-2. A 1099 form reports to the IRS the income you received from a company or individual who hired you as an independent contractor. It is important to understand that receiving 1099 income means you are not an employee of the company, but rather a self-employed individual. This means you are responsible for paying both income tax and self-employment tax on your earnings. While being a 1099 contractor and being self-employed are similar in many ways, there are some key differences to consider. In addition, it is important to understand the Self-Employment Tax and how it may affect your tax liability.

By using a 1099 tax calculator, self-employed individuals can plug in their estimated income, calculate self-employment tax, and estimate their total tax liability for the year.

Calculating Your 1099s Right: Income tax vs. self-employment tax

As a self-employed individual, it’s important to understand the difference between income tax and self-employment tax, and why you are required to pay both.

A 1099 contractor is an individual who provides services to a company or entity but is not considered an employee. While many contractors work for a set period under a contract agreement, they are not technically employed by the company and must pay their own self-employment taxes.

Income tax is levied on your total income, including wages earned from an employer, business income, investment income, and any other sources of income. The amount of income tax you owe depends on your total income, which is calculated by adding up all of your income from various sources.

Self-employment tax is based on what you earn from working. This includes income from self-employment, such as freelance work or running your own business. The self-employment tax rate is currently set at 15.3%, and it is calculated on the first $127,200 of your net income.

One factor that determines whether self-employed individuals pay more or less in taxes than employees of a company is whether they are able to take advantage of tax deductions. The self-employed are able to deduct business expenses, such as office supplies, marketing expenses, and equipment, from their taxable income. Additionally, they may be able to set aside money for retirement tax-free through a Simplified Employee Pension (SEP) plan, while employees of a company may only have access to a 401(k) plan.

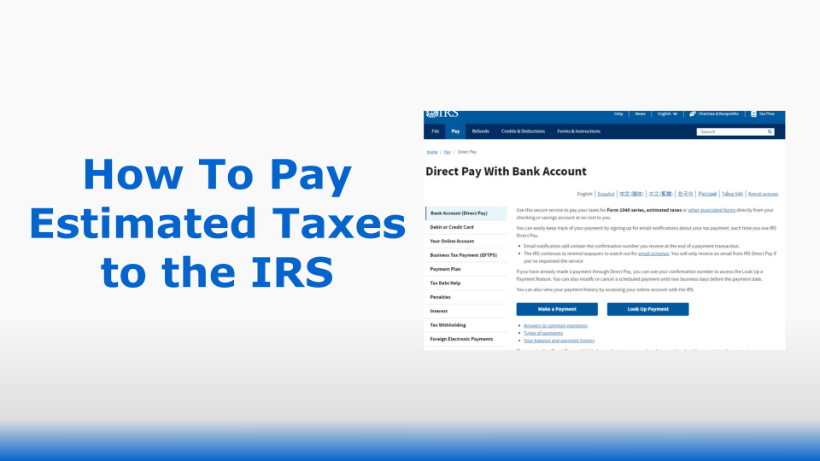

Another advantage of being self-employed is that, unlike an employee who has taxes withheld from their paycheck throughout the year, the self-employed do not have their taxes automatically deducted and must make quarterly tax payments. Rather than having to wait for a tax return to receive a refund, the self-employed may be able to receive their tax savings sooner through estimated tax payments.

On the other hand, being self-employed covers a wider range of scenarios. For example, a sole proprietor running their own business or a gig worker earning money through various online platforms would both fall under the umbrella of self-employment.

Estimating Your Taxes with a 1099 Tax Calculator

Accurately estimating your taxes using a 1099 Tax Calculator is a crucial step towards avoiding potential penalties and ensuring compliance with the IRS. To begin, gather all relevant information, including your filing status and sources of income for the year. This includes any self-employment income and business expenses.

If you are self-employed or have a business, you are responsible for paying both income tax and self-employment tax. While the two taxes are related, they differ in important ways.

Income tax is assessed on your total income for the year, including money earned from all sources. This includes wages, salaries, tips, interest income, dividends, rental income, and any other income you might have. Income tax rates vary depending on your tax bracket and other factors, such as whether you are married or single.

Self-employment tax, on the other hand, is designed to cover the costs of Social Security and Medicare, which are typically paid for by employers for their employees. Self-employment tax is calculated based on the first $127,200 you earn (as of 2017), with a rate of 15.3%.

However, there is a cap on the amount of income subject to the Social Security tax portion of the Self-Employment Tax, which is set at $142,800 for the year 2021.

Can a tax calculator reduce my actual tax liability?

Whether self-employed people pay more or less in taxes than those employed by someone else depends on a variety of factors, including how much money you make, your expenses, and your deductions. Generally speaking, self-employed people pay more in taxes because they are responsible for both the employer and employee portions of Social Security and Medicare taxes.

Once you have collected all the necessary information, enter it into the calculator accurately. This will allow you to determine your gross income, adjustments, deductions, and ultimately your taxable income.

One important thing to keep in mind is to double-check your inputs and calculations to avoid costly mistakes. These mistakes can lead to underpayment or overpayment of taxes, both of which can result in penalties.

Remember to include eligible deductions and credits in your calculation. These can significantly reduce your taxable income and decrease your tax liability. For example, if you’re a student or have dependents, you may be eligible for education expenses or the child tax credit.

Finally, review your estimate to ensure accuracy and take note of any necessary adjustments before filing your taxes. Accurately estimating your taxes with a 1099 Tax Calculator can go a long way in avoiding penalties and ensuring compliance with the IRS.

Common Mistakes to Avoid When Using a 1099 Tax Calculator

Make sure you’re using the correct form for your situation.

When it comes to accurately reporting your taxes as a household employer, using the right form for your situation is crucial. Taking the time to understand the regulations and forms required can save you from penalties and extra stress down the line.

First and foremost, it’s important to determine whether you are required to withhold Virginia income tax from your employee’s wages. You can do this by reading through the Basic Instructions for Household Employers. If Virginia income tax withholding is required, then you will need to register for a household employer’s account and file annually with Form VA-6H. Alternatively, you can register for an employer withholding tax account, which will require quarterly filing.

At the federal level, the IRS requires that you fill out Form 1040 Schedule H in order to report your household employment taxes. This form will help ensure that you are accurately reporting your household employment taxes and that you are properly withholding the required amount.

However, it’s important to note that if you have only paid independent contractors for services under $600, you do not need to report or withhold taxes. This is a critical point to remember since misclassifying employees as contractors can result in costly penalties.

By making sure you’re using the correct form for your situation, you can avoid confusion and ensure that you stay compliant with Virginia income tax and IRS regulations.

Don’t forget to include deductions and credits.

While using a 1099 tax calculator, it’s crucial not to forget about deductions and credits. These can significantly impact your final tax liability and can potentially maximize your refund or lower the amount owed. Deductions are expenses that you can subtract from your total income, while credits directly reduce your tax liability.

When filling out your tax information in the 1099 tax calculator, it’s important to list all the personal credits that you may be eligible for. These credits may include the $40 tax credit for individuals who are over 65 or legally blind, and military reserve members not being eligible. By listing all eligible personal credits, you can potentially increase your refund or lower the tax amount.

However, it’s essential to be aware of the existence of non-refundable credits as well. These credits cannot be used to reduce your tax liability below zero, so keep that in mind when entering information into your tax calculator.

Combining deductions and credits is a great way to see the highest reduction in your tax liability. For example, personal credits can often be used in combination with deductions for various expenses, such as childcare expenses for those who qualify. These deductions and credits together can result in a significant reduction in the tax amount owed.

In conclusion, by thoroughly investigating all available deductions and credits, and combining them where possible, you can effectively, and legally, decrease your final tax liability. Don’t forget to include all eligible personal credits and be aware of non-refundable credits to get the most out of your 1099 tax calculator.

Double-check your entries and calculations.

Double-checking your entries and calculations is an essential step in using the 1099 Tax Calculator. Accuracy is crucial when determining your final tax liability, and ensuring all data entered into the calculator is correct is the key to achieving that accuracy.

One critical area to review is any deductions or credits claimed. These can significantly impact your tax liability, and even a small mistake in data entry can result in an incorrect tax calculation. Double-checking these entries can ensure that you receive the deductions and credits you are eligible for, accurately reflecting your true tax liability.

It’s also important to check your calculations against the normal and regular income tax rates, as well as any applicable tax brackets for your filing status. Identifying any discrepancies can help prevent unexpected surprises when filing your taxes.

If you do notice any errors or discrepancies, make the necessary corrections to ensure accurate results. Taking the time to double-check your entries and calculations can save you time and hassle down the line, preventing any potential issues with the Internal Revenue Service (IRS).

Jacob Dayan

Entrepreneur • CEO Community Tax, LLC

Jacob Dayan is the CEO and co-founder of Community Tax LLC, a leading tax resolution company known for its exceptional customer service and industry recognition. With a Bachelor’s degree in Business Administration from the University of Michigan’s Ross School of Business, Jacob began his career as a financial analyst and trader at Bear Stearns and Millennium Partners before transitioning to entrepreneurship. Since 2010, he has led Community Tax, assembling a team of skilled attorneys, CPAs, and enrolled agents to assist individuals and businesses with tax resolution, preparation, bookkeeping, and accounting. A licensed attorney in Illinois and Magna Cum Laude graduate of Mitchell Hamline School of Law, Jacob is dedicated to helping clients navigate complex financial and legal challenges.