IRS Payment Plan: How Much Interest Does the IRS Charge?

Published:

Key Takeaways

- Interest Starts Right Away: If you owe taxes and don’t pay by the due date, the IRS immediately starts charging interest—there’s no grace period afforded to anyone.

- The Interest Rate Changes Every Quarter: It’s difficult to plan ahead for IRS interest rates (just in case you’re foreseeing a delay in your tax payments) since they adjust their interest rates every three months based on the federal short-term rate plus an additional percentage.

- It’s Compounded Daily: Yes, the IRS is pretty cutthroat when it comes to interest, as you can see. They calculate interest every single day, so the longer you take to pay, the more it adds up. Being even a week late can do some damage to your wallet.

- It Applies to Both Late Payments & Underpayments: There’s no distinction or reasoning when it comes to interests. Whether you pay late or simply didn’t pay enough when filing, interest still applies on the unpaid balance.

- Interest and Penalties Are Separate: If you thought that was bad enough, penalties and interests are applied separately. Besides interest, you may also owe late payment and late filing penalties, which stack on top of the interest charges.

The IRS is not known for being idle in any matter, but it becomes particularly serious when it comes to penalties and interests. Even if you manage to set up a payment plan for your late or unpaid taxes, the government will still charge you interest for the privilege.

Want to know how it works and how much it amounts to to avoid nasty surprises? Keep reading!

How Much Interest Does the IRS Charge On an IRS Payment Plan?

Is there simply no way you’ll be able to make your tax payments on time? For many people, it’s very difficult to pay the government in full and on time every year. Fortunately, there may be some options for you – including setting up an IRS payment plan.

While the government doesn’t pay you interest on the money they owe you if you get a tax refund, they do charge you interest on the taxes you owe but haven’t paid. Doesn’t seem fair, does it? That’s the nature of government.

The IRS will charge you interest when you set up a tax payment plan (i.e. installment agreement). This is your penalty for not paying your entire tax balance at once. Currently, the interest rate for underpaid taxes is 6%. The IRS updates the interest rates every quarter.

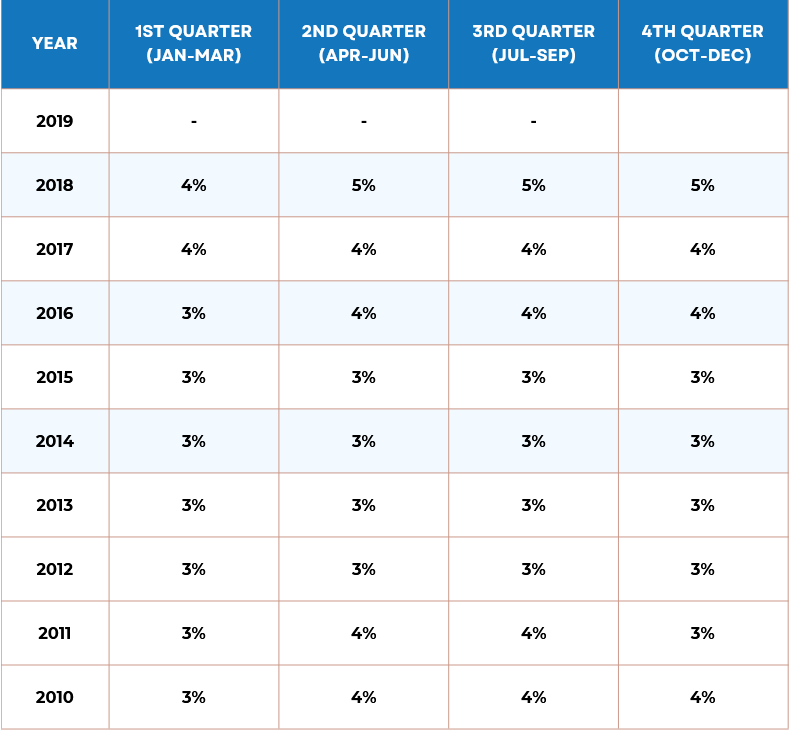

Here are the IRS interest rates over the past eight years, per quarter:

You will accrue penalties and interest on your tax balance until it is paid in full.

The IRS also charges various fees for setting up a tax payment plan. For a long-term payment plan (installment agreement) with automatic withdrawals, there is a $31 setup fee if you apply online, or a $107 setup fee if you apply by phone, mail, or in-person. For a long-term payment plan without automatic withdrawals – using a non-Direct Debit method of payment such as credit or debit card – there is a $149 setup fee to apply online, or a $225 setup fee to apply by phone, mail, or in-person.

If you want to change an existing payment plan you have with the IRS, it will cost you $89 to apply for that. In other words, an IRS payment plan can mean a big additional cost on top of what you already owe to Uncle Sam.

Pros and Cons of an IRS Payment Plan

On one hand, an IRS payment plan can help anyone who simply does not have the money to pay their taxes. This can include someone who has suffered a job loss or personal tragedy, or a business owner whose profits are sharply down.

On the other hand, failing to pay taxes can become a chronic problem. In fact, if you accrue other fees, such as failing to file a tax return on time, the IRS can also charge you penalties that can increase your tax bill by 25% or more.

Unfortunately, it’s difficult to make progress on bills when the interest and penalties add to the problem, which is why some people fall deeper into tax debt year after year.

Nonetheless, sometimes an IRS payment plan is helpful just to stay afloat after a bad year. In this case, make sure to set up the best possible IRS payment plan you can for yourself.

Figure out exactly how much you can pay each month without going under. However, don’t say you can pay more than you owe simply to get approved. Once the IRS payment plan is locked in, more penalties will apply if you fail to live up to the payment terms you and the IRS agreed on.

How Much Interest Does the IRS Charge?: FAQ

1. How does the IRS calculate interest on unpaid taxes?

The IRS charges interest based on the federal short-term rate plus 3% for individuals. This rate changes every quarter and is compounded daily, meaning the longer you take to pay, the more interest you’ll owe. These interests have also raised steadily for the past few years, so it’s not in your best interest to be late on your payments.

2. When does the IRS start charging interest?

As soon as legally possible! Interest begins the day after your tax payment is due (usually April 15). Even if you file an extension, the IRS still charges interest on any unpaid balance starting from the original due date, so that’s not an “escape plan” in case you were wondering.

3. How often does the IRS change its interest rate?

The IRS adjusts its interest rates every quarter (January, April, July, and October) based on changes to the federal short-term rate. While these changes are often slight (averaging +1% per adjustment), you probably don’t need more stuff to pay for as it is.

4. Does the IRS charge interest on penalties too?

Yes! If you get hit with a late payment or late filing penalty, the IRS also charges interest on those penalties, making your total balance grow even faster. The main goal is to make you pay in full as quickly as possible, so we absolutely do not recommend playing the long game with the IRS.

5. Can I negotiate or reduce IRS interest charges?

Unfortunately, interest is automatic and can’t be waived unless the IRS makes an error and you have evidence (which is incredibly rare, so maybe don’t pin your hopes on that scenario). However, penalties can sometimes be reduced or removed if you can show reasonable cause for missing your payment, usually from significant life events or acts outside of human control.

6. How can I stop IRS interest from adding up?

Like we mentioned, the IRS has the goal of making you pay your balance in full ASAP, so the only way to stop interest from growing is to pay off your balance as soon as possible. If you can’t pay in full, setting up a payment plan can help prevent further penalties and keep interest from spiraling out of control, but make sure to keep that under control as well, or you’ll just end up with a bigger problem.