Key Takeaways

- The IRS considers any form of additional compensation to your wages as a bonus. And yes, they also consider bonuses taxable.

- No, bonuses are not “taxed higher” than wages. Your employer withholds a federally-mandated 22% of your bonus for tax purposes, but most of that will generally be refunded to you after you file your tax return.

- For certain jobs, your employer will combine your wages with your bonus to use a single tax rate for both.

- The “supplemental wages” category includes overtime, commissions, severance, tips, back pay, prizes, and much more.

- Using your bonus to make a qualifying contribution towards tax-advantaged account (like 401(k) or HS) could help you lower your tax liability and plan for the future at the same time.

How are bonuses taxed? It’s a valid question since, after a year’s worth of hard work helping your company meet its goals, getting a bonus feels like a well-deserved reward for any red-blooded American.

As bonuses count towards your yearly income, it’s subjected to income tax laws; still, many feel like their bonus gets taxed higher than it should. Well, how are bonuses taxed? Keep reading to learn how tax laws apply to your bonuses, and how you can reduce your tax liability.

How Are Bonuses Taxed?

In the U.S., it may seem like bonuses are taxed higher than usual based on the withholding process, but it’s actually not a question of higher or lower percentages; the reality is that bonuses are taxed in a different way from regular income.

The reason why is because bonuses are classified as “supplemental wages” under IRS guidelines, which causes employers to use a flat withholding rate of 22% (which is actually prescribed by the IRS) to cover the estimated taxes owed.

Admittedly, this bonus taxation rate of 22% might seem elevated if you compare it to regular income withholding rates in the U.S., depending on the state of course, and the calculations get a tad more complex once you factor in the tax bracket to which an employee belongs.

What Is A Bonus?

“Is my bonus taxable?” might be the first question on your mind. Well, first we have to cover the basics about what exactly is a bonus: The IRS considers a bonus as any form of additional compensation that a worker is paid on top of their regular wages by their employers at their discretion.

They fall into the “supplemental wage” category of income along with overtime, sales commission, severance packages, back pay, tips, award money, prizes, payments for accumulated sick leave and nondeductible moving expenses, and others.

How Bonuses Are Taxed

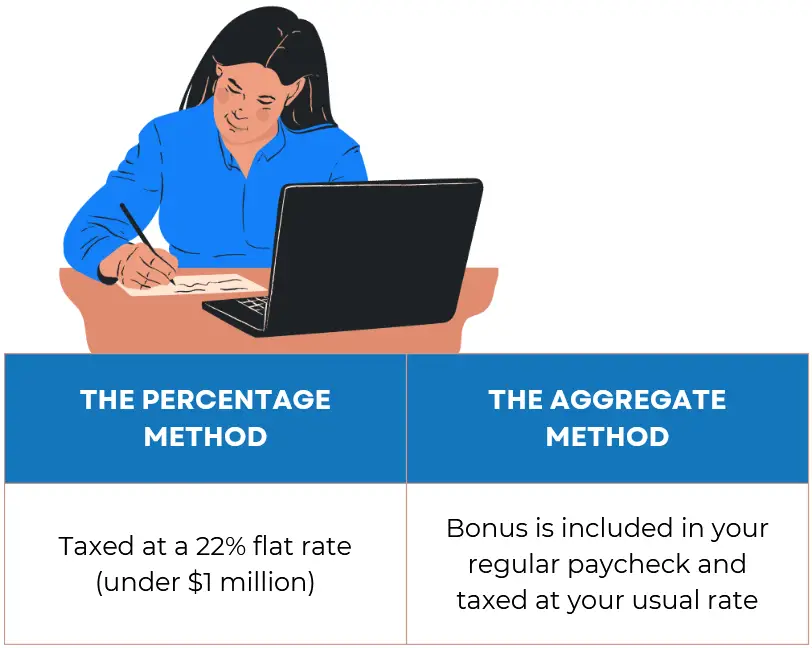

First of all, you must know that there are two different ways in which bonuses are taxed:

- Percentage-Based Bonus Taxation: This means that your employer will consider your bonus payment as a separate (or “supplemental”) income from your regular wages and automatically withhold the 22% bonus tax rate we mentioned above. This is the only option your employer has if you make more than $1,000,000 in bonuses alone in a calendar year (more on that below).

- Aggregate Bonus Taxation: Your employer may combine your bonus with your regular wages in a single payment without specifying the amounts of each when reporting to the IRS. This allows them to withhold the same tax rate on the entire sum as one single payment. This is a common practice in commission-based jobs, where employees earn bonuses through the year instead of as a single lump sum.

For employees in lower tax brackets, the difference can be more notorious due to different allowances and adjustments, particularly for those who have filled Form W-4, making the difference between their regular income withholding and that of their bonus seem excessive.

However, once that employee files their tax return, their total tax liability will be based on their cumulative income, which will include both wages and bonuses, allowing them to recover any tax withheld from that same bonus provided that their overall tax rate is lower than 22%.

You can use the IRS’s tax withholding calculator to see how this will apply to you.

Example

Take an employee with an annual income of $40,000, a $1,000 bonus at the end of the year, and a marginal tax rate of 12%. The IRS’s 22% flat withholding rate means that $220 out of the $1,000 bonus will be withheld right away, leaving $780; compared to that employee’s usual income tax rate of 12%, this makes it seem as if the bonus tax rate was way too high.

However, when the employee fills in their total taxable income during tax season, adding up to a total of $41,000 ($40,000 yearly income + $1,000 bonus), two things will happen:

- The employees total taxable income of $41,000 falls into their usual 12% tax bracket.

- The IRS determines this employee’s total owed taxes based on the 12% rate (instead of the 22% rate used for the bonus), then gets a refund on the bonus since they paid more than they actually owed.

Things play out differently for employees with higher salaries, since their bonus can be subjected to additional withholding on top of the flat 22% if their bonus crosses a certain threshold.

The IRS actually requires explorers to withhold, at the highest marginal tax rate for that employee, any supplemental income and cumulative bonus that surpasses $1,000,000 in a calendar year.

Example

Suppose that an employee with a marginal tax rate of 37% (which is the highest federal income tax bracket for 2024) gets a bonus worth $1,500,000.

This would mean that $1 million of that bonus would be withheld at the 22% flat rate, while the remaining $500,000 would be subjected to withholding at that employee’s marginal tax rate of 37%.

Remember that the example provided above is merely an advance withholding calculation and not a final tax assessment; during tax season, applicable deductions and the actual liability will be factored into the calculations, and a tax refund is possible if that employee has overpaid.

The Difference Between Withholding And Tax Rate

Perhaps the greatest source of confusion surrounding the way bonuses are taxed is the failure to understand the difference between withholding money upfront for tax purposes and the actual tax rate applied at the end of the year.

The summary version of it all is that withholding refers to the amount of money that your employer docks out of your paycheck to use at the end of the year to pay taxes; meanwhile, your actual tax rate is the percentage of your total income that goes to taxes at the end of the year.

Withholding Rate On Bonuses

Like we mentioned before, your actual wages are taxed using a different rate that is based on your tax bracket.

Meanwhile, bonuses are classified as supplemental wages, an entirely different category of wage that uses a flat 22% withholding rate, which is most certainly higher than your own tax bracket.

Why is this done? Simply put, to make sure that enough taxes are collected through the year to cover what you owe to the IRS at the end of the year.

Actual Tax Rate

The IRS calculates how much you owe based on your total annual income, which includes essentially every dollar you make that falls into their taxable income categories (and they are extensive).

Your actual tax liability, meaning the total amount you owe the IRS, is determined when you file your income tax return and make all applicable deductions and exemptions; the tax rate used for this is called “marginal tax rate” and follows a very simple correlation of “higher total income = higher tax rates”.

How Bonus Withholding And Actual Tax Rates Interact

The 22% withholding rate does not account for your actual income bracket, which is why it feels so high compared to everything else you’re taxed on.

For lower earners, a withholding rate of 22% might even feel unfairly high, giving them the sense that bonuses are over-taxed and not actually worth it.

For the reasons stated above, it’s important to remember that, for the vast majority of taxpayers, the amount withholden from their bonuses will most likely not be the amount that the IRS will keep at the end of the year.

More often than not, the IRS will simply conclude that you’ve overpaid on the bonus and will refund you for the excess (now using your actual tax rate).

So you see, the key difference here is that, while it is usually done in order to have enough money for taxes, withholding is not taxing.

Therefore, a higher withholding rate is preferred because it means that, at the end of the year, the withholden amount of money will always be enough to cover your tax liability and the rest will be refunded to you.

Minimizing The Tax Liability Of A Bonus

Here are some things you can do to minimize the impact of tax rates on your bonus. Please remember that this is not a guide on how to circumvent paying taxes on your bonus or regular wages, just guidelines on how to help you lower the impact that your regular taxes have.

1. Make Sure Your Bonus Is Taxable

When we say that all bonuses are taxable, we mean monetary bonuses. The IRS generally considers some fringe benefits, usually those that are intermittent and low-value enough, to be taxable.

These include things such as tickets for events, holiday gifts, low amounts of cash to cover food expenses when working overtime, books, etc. Still, it is a good idea to consult with a tax professional if you believe that a gift of award that you got at work has tax implications.

2. Review Your W-4

Form W-4 is a great tool for adjusting your tax withholdings, especially if your job hands out bonuses frequently throughout the year; these get added to your total earned income at the end of the year, and could end up increasing your tax liability if you are not careful.

Make sure to make any necessary adjustments before any bonus is paid out, and don’t be afraid to consult a tax expert if necessary.

3. Defer Your Bonus For A Later Time

If it’s too late in the year to make adjustments to your W-4, you can ask your employer to defer your bonus until the next year if you think it will push your income into a higher tax bracket, or if you deduce that your total income for the following year will be lower than the current one, lowering your tax liability.

Either way, remember that deferring a bonus does not mean eliminating the taxes on it — you are merely deferring the payment on those taxes along with the bonus itself.

4. Use Your Bonus Toward A Tax-Advantaged Plan

Using your bonus to make a qualifying contribution towards a long-term savings goal is a good idea if you haven’t hit the yearly contribution limit on them.

All payments towards tax-advantaged plans such as a 401(k) or HSA is pre-tax, which can lower your taxable income at the end of the fiscal year and make a great addition to your retirement plan of choice.

So, Are Bonuses Taxed Higher?

The short answer is no, bonuses are not taxed higher than your regular income because the IRS has different rules set for them.

Still, it is easy to see how, when looking at a 22% withholding flat rate, an employee in a lower tax bracket might ask “why are bonuses taxed more than my regular income?”.

But, come tax season, they will notice how their final tax calculation reflects their lower tax bracket instead of the initial 22% rate, and any extra that was withheld from their bonus upfront can be refunded.

Remember that 22% is not the federal tax on bonuses, merely the withholding rate for taxation purposes.

Frequently Asked Questions

1. Are bonuses taxed higher than regular wages?

No, bonuses are not taxed at a higher rate than regular wages, but they do have a higher upfront withholding rate (usually 22%). Once you file your taxes, they’re taxed using your regular income rate and are eligible for refunds if you overpaid, which is usually the case if you’re in a lower income tax bracket.

2. Is my bonus taxable?

Yes, all bonuses are considered part of your income (as “supplemental income”) and as such taxable, and are subject to federal, state, and sometimes FICA taxes.

3. What is the federal tax on bonuses by the IRS?

The IRS requires your employer to apply a 22% flat federal withholding rate on any bonuses paid to you on top of your regular income, with additional withholding for bonuses exceeding $1,000,000 in total.

Nick Charveron

Nick Charveron is a licensed tax practitioner and Partner & Co-Founder of Community Tax, LLC. As an Enrolled Agent, the highest tax credential issued by the U.S. Department of Treasury, Nick has unrestricted practice rights before the IRS. He earned his Bachelor of Science from Southern Illinois University while serving with the U.S. Army Illinois National Guard and interning at the U.S. Embassy in Warsaw, Poland. Based in Chicago, Nick combines his passion for finance and real estate with expertise in tax and accounting to help clients navigate complex financial challenges.