Topics

Blog

Premium Tax Credit

Offset the Cost of Your Health Insurance Premiums Families and individuals who get their health insurance through the Health Insurance Marketplace may be able to…

5 Tips for People Who Owe Taxes

What To Do If You Owe Money to the IRS If you owe taxes, it may feel as though you’ve been cast adrift upon a…

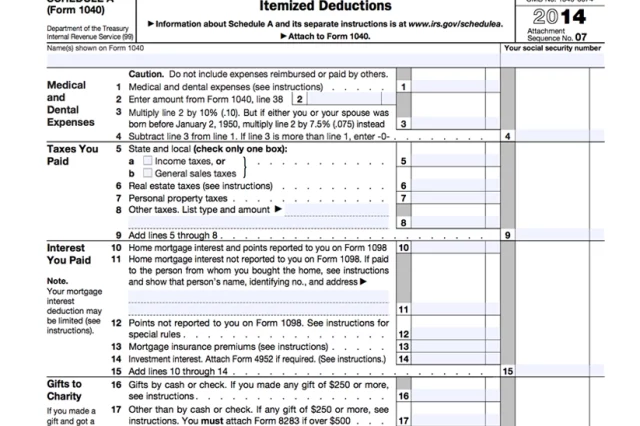

Top 5 Most Popular Itemized Deductions for U.S. Taxpayers

[video width="1280" height="720" mp4="https://www.irs.com/wp-content/uploads/2015/10/Top_5_Tax_Deductions_Explained1.mp4"][/video] Itemizing your tax deductions can decrease your taxable income by a sizable amount, but you can’t just choose whatever expenses…

Tax Tips for Retired Persons

Special Tax Considerations for When You Retire Many people believe that once they retire, they will pay less in taxes due to a lower income.…

The Additional Child Tax Credit

A Refundable Tax Credit for Parents If you have children, you may be able to lower your tax bill by claiming the Child Tax Credit.…