Topics

Blog

Alabama Tax ID (EIN) Number & Business Registration

Looking to register a Tax ID Number and/or start a business in Alabama? You can do both online, simply follow the steps below.When you're ready…

North Carolina Tax ID (EIN) Number & Business Registration

Looking to register a Tax ID Number and/or start a business in North Carolina? You can do both online, simply follow the steps below to…

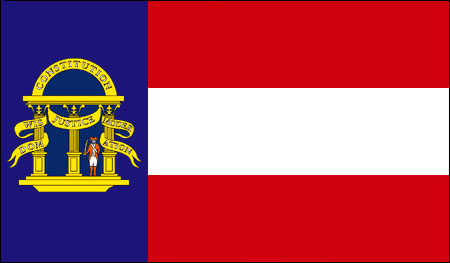

Georgia Tax ID (EIN) Number & Business Registration

Looking to register a Tax ID Number and/or start a business in Georgia? You can do both online, simply follow the steps below. Entrepreneurship is…

Oklahoma Tax ID (EIN) Number & Business Registration

Are you looking to start a business and obtain your Oklahoma Tax ID (EIN) Number online? In Oklahoma, opportunities for entrepreneurs are plentiful–as long as…

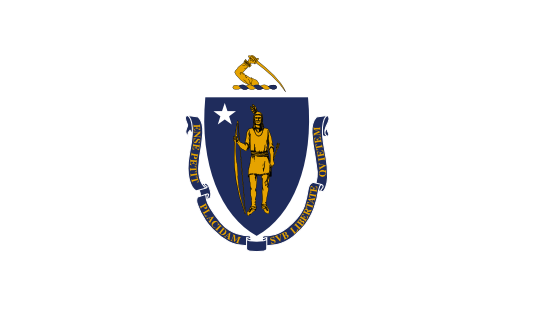

Massachusetts Tax ID (EIN) Number & Business Registration

Massachusetts is very welcoming to entrepreneurs and small businesses. The Commonwealth is home to many small firms, with 86 percent of its businesses having 20 employees or…

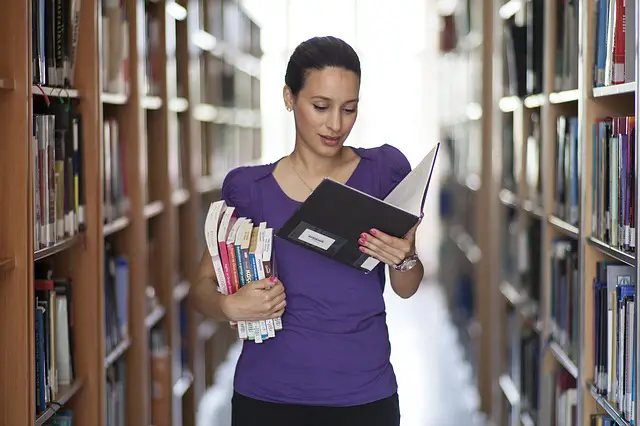

Education Tax Breaks for Your Federal Return

Lower Your Tax Bill By Claiming Tax Credits & Deductions for Education Expenses If you, your spouse, or dependent child pursued a higher education,…

Louisiana Tax ID (EIN) Number & Business Registration

Louisiana is home to more than 424,000 small businesses, with close to 900,000 people in the state employed by those small businesses. Approximately 97.3 percent of…

Arkansas Tax ID (EIN) Number & Business Registration

Starting a business in Arkansas isn’t especially complicated, but there are some key points you’ll need to consider before moving forward. Before you get lost…