Topics

Blog

October 15 Tax Extension Deadline Approaches

Tax Extension Filers: Your 2019 Tax Return Is Due By October 15, 2020 This is an important reminder for taxpayers who filed an extension. If…

Tax Deductions For Medical Expenses & Health Insurance

Federal Tax Breaks to Help With the Costs of Medical Care & Health Insurance Premiums The cost of health insurance and medical expenses can be…

IRS Reopens Registration Period for Economic Impact Payments

The IRS Is Taking New Steps to Ensure People Get Their COVID-19 Payments The Internal Revenue Service (IRS) recently announced that it has established a…

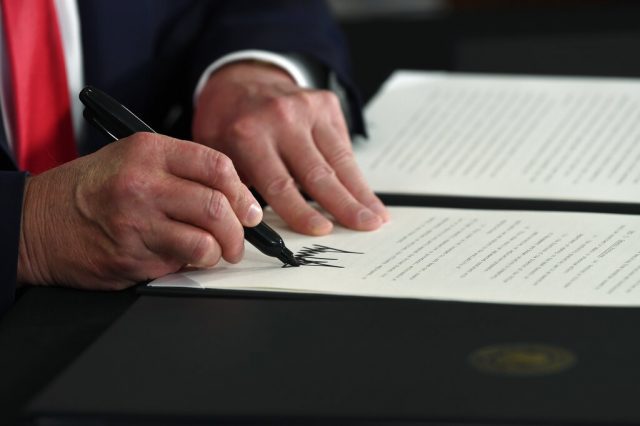

Trump Signs 4 New Executive Orders for Coronavirus Relief

President Trump Issues Executive Actions to Help Americans Struggling Because of COVID-19 - What’s Included & Which Programs Are Funded? President Donald Trump signed four…

What to Expect from the Second Coronavirus Stimulus Package

The Next COVID-19 Relief Bill Is Being Negotiated – What Benefits Will It Include? On Capitol Hill, U.S. lawmakers have been working on a second…

The CARES Act: What You Should Know About the Coronavirus Relief Stimulus Package

Breaking Down the $2 Trillion Coronavirus Aid, Relief, and Economic Security (CARES) Act – What’s Included & How Affects You The Coronavirus Aid, Relief, and…

$484 Billion Interim Coronavirus Relief Bill Signed Into Law

What’s Included in the Latest Emergency COVID-19 Package President Donald Trump signed a new $484 billion interim coronavirus relief bill on Friday, April 24, 2020…

Coronavirus Relief Stimulus Package: Information About Student Loan Aid

What You Should Know About the Payment Suspension for Federal Student Loans The Coronavirus Aid, Relief, and Economic Security Act (a.k.a. CARES Act) was signed…