Topics

Blog

Required Reading for Anyone Worried About Their 401k RMDs (Required Minimum Distributions)

What Is a Required Minimum Distribution? The dreaded RMD of 401ks. A 401k is an employer-sponsored retirement account that allows employees to save for their…

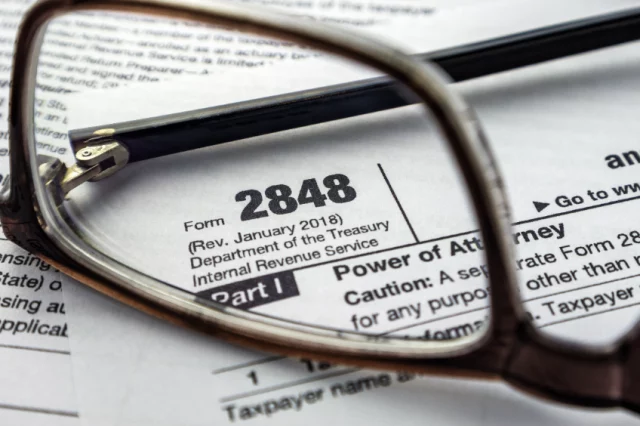

Power of Attorney and When to Use Form 2848 With the IRS

I didn't realize there was a form for this! The 2848 form is an Internal Revenue Service (IRS) document used to authorize a third party…

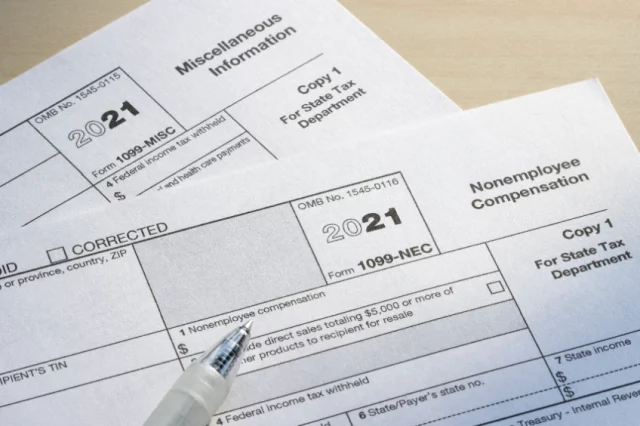

Get to Know Form 1099, How Independent Contractors Talk to the IRS

Form 1099 is a tax form used to report income from independent contractors. It is sent to the contractor by the client and also to…

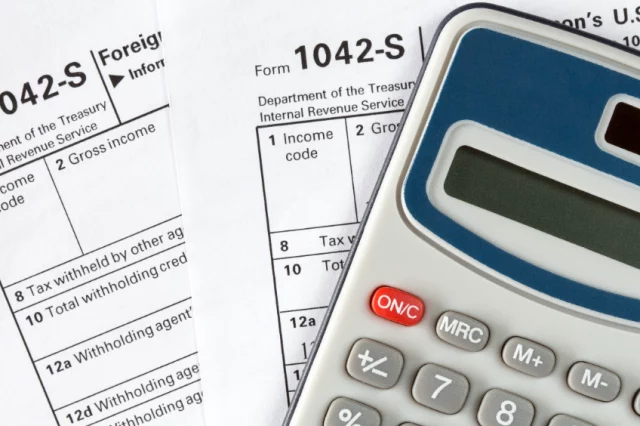

Making Sense of Tax Form 1042-S for Reporting Income Paid

When filling out a 1042-S form, it's important to provide information about the source of the income being paid and the type of income being…

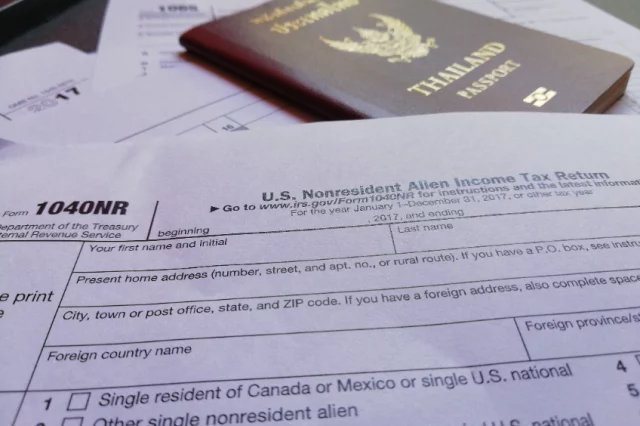

The Ins and Outs of 1040-NR for Nonresident Aliens and U.S. Expatriates

Nonresident Aliens and Tax Obligations I hear Canada's nice this time of the election cycle. Nonresident aliens are individuals who are not U.S. citizens or…

Capital Gains Taxes and the Key Inside the 28% Rate Gain Worksheet

What is the 28% Rate Gain Worksheet? The capital gains tax is a tax on profits from selling a capital asset. It applies to a…

The Major Deadlines for 1099s: When Your 1099 Forms Are Due

The due date for 1099 forms depends on the type of 1099 you are filing. Generally, Form 1099-MISC is due to the IRS and to…

What Every Senior Should Know About the 1040-SR Tax Form

The 1040-SR is a special tax form designed to help seniors file their taxes more easily. It was created as part of the Bipartisan Budget…