Topics

Blog

How to Navigate the (Slightly Simpler) Alternative Tax System: The Alternative Minimum Tax Calculator

There's an alternative to regular taxes? Yeah, paying more. Alternative minimum tax (AMT) is a tax system implemented in the United States to ensure that…

Which 990 Form Should My Tax-Exempt Organization Use?

You might be exempt from taxes, but no one's exempt from paperwork! What is IRS Form 990 and why is it important? IRS Form 990…

Do Capital Gains Count as Income When I’m Doing My Taxes?

Gains, income, gravy train - it's all the same, isn't it? Not to Uncle Sam. Do capital gains count as income for tax purposes? Why,…

Math Errors and Missed Deductions: When You Should File an Amended Tax Return and How to Track Yours

What to do when something doesn't add up on your tax refund. When it comes to filing a tax return, mistakes can happen. Fortunately, taxpayers…

What’s The Right Way To Use Tax Form 540, California Resident Income Tax Return

Look! It's the tax form all the movie stars use! What is the IRS 540 Tax Form? The IRS 540 tax form, also known as…

Foreign Accounts and Financial Assets with Form 8938: The Facts on Complying With FATCA

So all those Bond villains with Swiss bank accounts still pay taxes? With this form, yes. What is Form 8938? Form 8938 is a requirement…

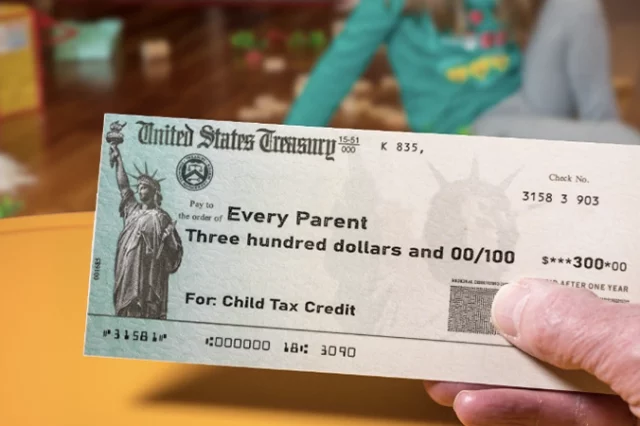

The 2023 Child Tax Credit Payment Schedule: Only Annual Tax Credits (For Now)

If you're looking for a "payment schedule" to your child credit, well, the good news is there still is a child tax credit. The Child…

Procrastinate At Your Own Risk: You Can Go to Jail for Not Filing Your Taxes

Yes. It's how they got Al Capone, right? Boy, I hope no one's googling this on a work computer. Tax evasion is a criminal offence…