Topics

Blog

Understanding the IRS Hardship Program

Sometimes unforeseen financial difficulties can arise, leaving individuals and businesses struggling to fulfill their tax responsibilities. The Internal Revenue Service (IRS) recognizes these challenges and…

Nonprofits With Tax Returns: What Are IRS Form 990 and Form 990-EZ Used For?

There's no profit in not turning in your Form 990s! When it comes to keeping your organization's tax-exempt status in good standing, IRS Form 990…

How Are Cryptocurrencies Taxed? When You Pay Taxes on Bitcoin, What’s Your Taxable Income?

And you thought e-filing your taxes was the hottest, new-fangled doodad the IRS tracked. When it comes to cryptocurrency taxes, the Internal Revenue Service treats…

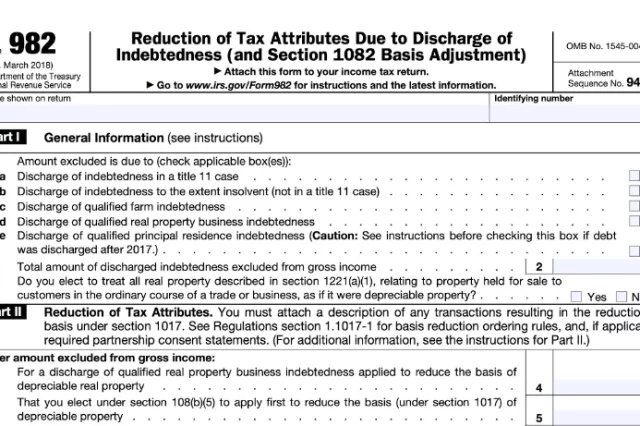

Form 982: The Lifeline IRS Form

Did you get any debts canceled or forgiven this year? You may need IRS tax form 982. Claiming insolvency with form 982 can let…

President Biden’s SAVE plan is not entirely tax free

The new income-driven repayment plan (IDR) proposed by President Joe Biden (known as the SAVE plan) may be able to forgive some student loans…

Where’s My Refund? Lost in the Mail, If You Don’t Follow the New Mail Forwarding Policy from USPS

Everyone always asks how to contact the IRS, but can the IRS contact you? Wondering what’s taking your federal tax return and refund so long?…

Caught In the Net Investment Income Tax? When to File Form 8960

Excited about passive income? So were we, until we got to the NIITy gritty. Form 8960, also known as the Net Investment Income Tax Individuals,…

How Does Form 8992 Work? Round-the-world Tour of Global Intangible Low-Taxed Income (GILTI)

It's not that kind of guilty, your honor. Form 8992 is an essential IRS tax form that requires U.S. shareholders of controlled foreign corporations (CFCs)…