Topics

Blog

Taxes Withheld From Paycheck: What Is Federal Withholding?

If you've ever looked at your paycheck and wondered where a chunk of your money disappeared to, you're definitely not alone. Taxes withheld from your…

Tax Credits

What Are Tax Credits & How Do They Lower Your Tax Bill? Tax credits can help reduce your liability dollar-for-dollar. That being said, they generally…

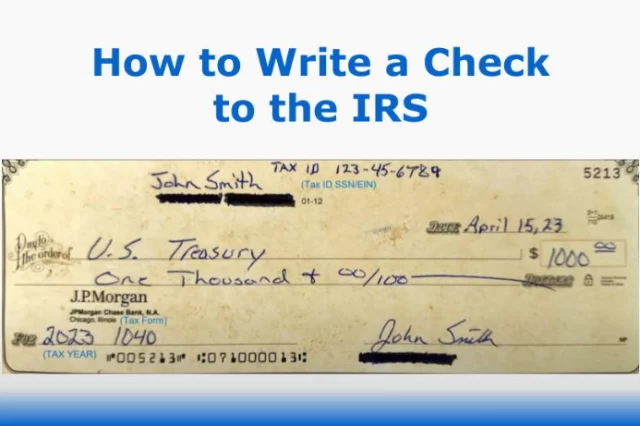

Every Tax Payment Method You Can Use

[video width="1280" height="720" mp4="https://www.irs.com/wp-content/uploads/2025/03/Top_6_IRS_Payment_Methods.mp4"][/video] Can I pay my taxes online? That’s a question that we run into all the time. Individuals have many…

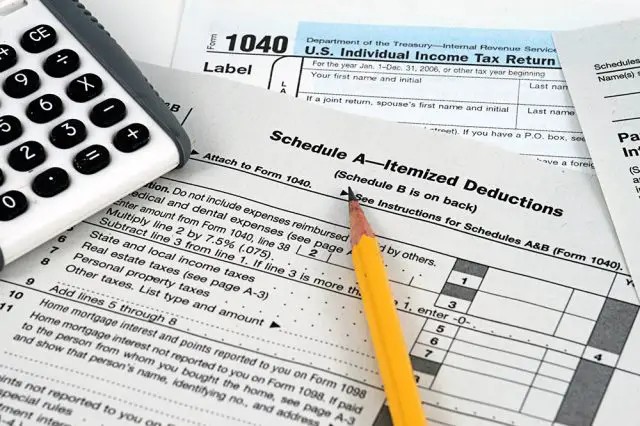

How to E-File Taxes Online

Do you think the IRS wants all those paper returns? Think again. You have multiple e-file options available to file your taxes with the Internal…

E-File Your Federal Taxes Online for Free

Whether you owe Uncle Sam or you’re expecting an income tax refund, the federal government has opened the doors to allow taxpayers to e-file taxes…