Key Takeaways

- Some tax credits are the Earned Income Tax Credit (EITC), the Child Tax Credit, and the Premium Tax Credit.

- Tax credits can bring substantial savings on your federal tax bill because it reduces it dollar-for-dollar. A $500 tax credit means $500 off your tax liability, full stop.

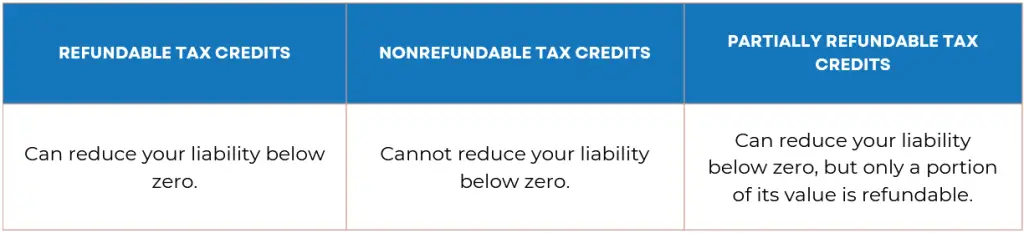

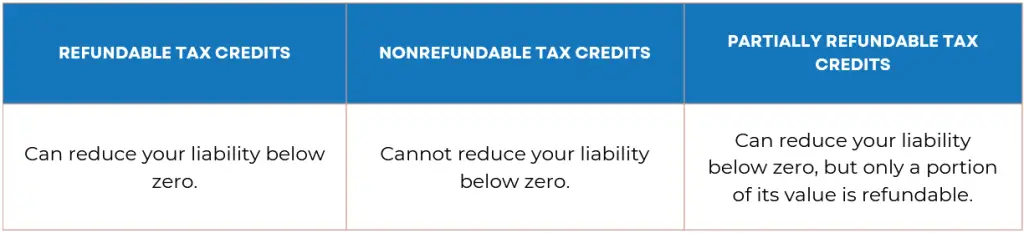

- Refundable tax credits can reduce your tax liability below zero, and the negative amount that “exceeds zero” will be given back to you as a tax refund.

- Nonrefundable credits are subtracted from your tax liability, up to the total amount you owe, but cannot reduce your tax balance beyond zero.

- Whether or not a tax credit is refundable, it is worth the effort to make sure you are claiming every credit that you’re eligible for.

Sometimes credits can be too much, and we mean that in every sense of the word. Thankfully, tax credits offer some much needed relief to the overwhelmed taxpayer.

Tax credits are a fantastic way to reduce your tax liability (the amount of money you owe in taxes), and some of them can even give you a tax refund (or make it bigger).

So, credits are great, but do you know the difference between refundable and nonrefundable tax credits? Do you know how each of them work? How about partially refundable tax credits?

As with all things tax-related, tax credits can be quite the complex topic, so this guide will go into the specifics of each type of tax credit, how they work, and how you can take advantage of them during tax season. Let’s dive in!

RELATED: Tax Credits for Families With Children & Dependents

What Are Tax Credits?

The IRS defines tax credits as a dollar-for-dollar amount that a taxpayer can claim on their tax return in order to reduce their tax liability. If you’re eligible for a tax credit, that means that you can reduce how much you owe in taxes by whatever amount the credit is valued at.

What’s The Difference Between A Tax Credit And A Deduction?

Believe it or not, when it comes down to it, tax credits help you save more money than deductions, because the latter only reduce your taxable income while the former actually reduce your total tax bill. Let’s look at how with an example:

- Suppose that your taxable income is $50,000 and you have $10,000 in deductions. That means your new taxable income is $40,000. Now, hypothetically, let’s say your tax rate is 18% for your entire taxable income; that means your tax liability would be $7,200.

- Now imagine you have a taxable income of $50,000 but you’re eligible for a $10,000 refundable tax credit. At a tax rate of 18%, your tax liability would be $9,000; but remember, tax credits reduce what you owe dollar-for-dollar, which means that with a $10,000 credit, not only do the the $9,000 in owed taxes turn to zero (-$1,000, actually), but since the credit is refundable, the extra $1,000 are now owed to you.

- As you can see, the difference is plain as day. In this hypothetical scenario, you would owe $7,200, but with tax credits your liability was virtually eliminated and actually got a $1,000 refund.

Reducing Your Tax Bill with Refundable Tax Credits or Non-Refundable Tax Credits

When we say that tax credits give you a dollar-for-dollar reduction of your tax bill, we do mean dollar-for-dollar. For example, a $500 tax credit actually takes $500 off your tax balance due.

A tax deduction, on the other hand, reduces your taxable income and is equal to the percentage of your marginal tax bracket — for example, if you’re in the 10% tax bracket, a $500 tax deduction will save you $50 in taxes (because 0.25 × $500 = $50).

Now you can see why a tax credit is more valuable than a dollar-equivalent tax deduction.

However, not all tax credits are created equal. Most tax credits are nonrefundable, which means that any excess amount expires the year in which it is used and is not refunded to you.

However, some tax credits are refundable and can actually increase your tax refund.

RELATED: The Expanded Child Tax Credit

Refundable Tax Credits

Refundable credits are the most versatile type of tax credit. These credits are treated just like tax payments that you make to the IRS, such as income taxes withheld from your paycheck or estimated tax payments that you make throughout the year.

In other words, a refundable credit is subtracted from the amount of taxes you owe (after deductions), similar to the way the tax withheld from your paycheck is subtracted from your total yearly tax liability.

A refundable tax credit is particularly advantageous because it can reduce your tax liability to below zero. If the amount of a refundable tax credit is more than the amount of taxes due, the difference will be given back to you as a tax refund.

If you are already owed a tax refund, the refundable credit will be added to increase the amount of your refund.

Here are some examples of refundable tax credits:

- Additional Child Tax Credit: The Additional Child Tax Credit is a subset of the Child Tax Credit (with only the latter being refundable up to $1,700). Your income must be below $400,000 for couples filing jointly or $200,000 for all other filing statuses.

- Earned Income Tax Credit (EITC): This credit helps low-to-moderate income working individuals and families and could give you a tax break of up to $7,830 for the 2024 tax year (depending on your income). You don’t need children to qualify, contrary to popular belief, but having children does have the potential for giving you a higher credit amount.

- Health Coverage Tax Credit: With the HCTC, you could have up to 72.5% of qualified health insurance premiums paid for (if you or your family are eligible).

- Small Business Health Care Tax Credit: This is a credit worth up to 50% of the costs of your employees’ premiums (or 35% for non-profit employers). It’s meant for “employers that pay average wages of less than an inflation-adjusted amount a year per full-time equivalent” according to the IRS.

RELATED: Top 5 Tax Deductions for Individuals

Non-Refundable Tax Credits

Nonrefundable credits are another great way to decrease your tax bill. A nonrefundable credit is subtracted from your income tax liability, up to the total amount you owe.

But unlike a refundable tax credit, a nonrefundable credit cannot reduce your tax balance beyond zero. Any unused portion of a nonrefundable tax credit will expire in the year the credit is claimed and cannot be carried over.

Some examples of nonrefundable tax credits include:

- Adoption Tax Credit: Adopting a child makes you eligible for the Adoption Tax Credit, which goes up to $16,810 in qualified expenses for the 2024 tax year.

- Child Tax Credit: As we mentioned in the previous section, only the “additional child” portion of the credit is refundable. Still, the Child Tax Credit gives you a tax break for qualifying children of up to $2,000 per kid.

- Foreign Tax Credit: This is a tax credit that you can apply for if a foreign country imposes taxes on you. It’s meant to relieve your tax burden when your income is taxed by both a foreign country and the U.S.

- Electric Vehicle Tax Credit: Worth up to $7,500, the EV Tax Credit incentivizes the acquisition of an electric vehicle. This credit is nonrefundable on top of not being transferable for future years.

Partially Refundable Tax Credits

Certain tax credits are considered partially refundable because they fit into both categories. In these cases, only a portion of the tax credit can be refunded to you.

aThis type of credit is a bit more complicated — it can be subtracted from the amount of taxes owed and (to an extent) applied to increase the tax refund.

The American Opportunity Tax Credit (AOTC) is an example of a partially refundable credit. The maximum credit amount is $2,500 per eligible student, per year. If the credit reduces your tax liability to zero, you can receive up to 40% of the remaining credit amount (up to $1,000) as a tax refund.

Some examples of partially refundable tax credits include:

- American Opportunity Tax Credit (AOTC): This credit was designed to help students and their families manage the ever increasing cost of higher education. After the credit reduces the amount of taxes you owe to zero, you can get a refund of up to 40% of the remaining amount (and up to a maximum of $1,000 per credit). This makes it a very valuable credit for college students.

RELATED: Taxes & Education

How To Know If You’re Eligible For A Tax Credit

Eligibility for tax credits is defined on a case-by-case basis, since each federal tax credit comes with its own set of rules and exclusions.

Some of the most popular tax credits for low-income taxpayers, the Earned Income Tax Credit (EITC), has a substantial amount of rules attached to it, so income is only the first of many hurdles you’ll have to jump through in order to qualify for a federal tax credit.

The Final Word on Refundable vs. Non-Refundable Tax Credits…

Whether or not a tax credit is refundable, it is worth the effort to make sure you are claiming every credit that you’re eligible for.

Additionally, since the rules and amounts for tax credits change every year, it is important to do the proper research before preparing your income tax return.

For more information about federal tax credits, please refer to IRS Publication 17 (Tax Guide For Individuals).

Refundable Tax Credits vs. Non-Refundable Tax Credits: FAQ

1. What is a tax credit?

Tax credits are a dollar-for-dollar reduction in the amount of taxes you owe to the government (AKA your tax liability). That means that each dollar in a tax credit is one less dollar you have to pay on taxes, full stop.

2. What’s the difference between refundable and non-refundable tax credits?

With a refundable tax credit, if the credit amount exceeds your total tax liability, that means the excess part is refunded to you; the implication is that you can even receive money back even if you have zero tax liability. On the other hand, for a non-refundable tax credit, if the credit amount exceeds your tax liability, that excess is forfeited since the credit can’t reduce your liability below zero; in other words, you can’t get the unused portion of the credit.

3. What are the names of some refundable tax credits?

Some of the most requested refundable tax credits are the Earned Income Tax Credit (EITC), the Child Tax Credit (this one’s only partially refundable), and the Premium Tax Credit.

4. How do I know if a tax credit is refundable or non-refundable?

The IRS differentiates between refundable and non-refundable credits in their publications, forms, and website. A tax professional or your tax preparation software of choice should also be able to identify each type of credit for you.

5. Which type of tax credit should I claim first when filing my taxes?

Both types of credits are valuable since both of them lower your tax liability, but refundable tax credits have the added benefit of potentially resulting in a refund for you. Regardless, it’s important that you claim all credits for which you qualify in order to maximize your tax benefits.

6. Do tax credits have an expiration date?

While some credits expire if not used in the current tax year, others (mostly non-refundable credits) can be carried either forward to future tax years and even back to prior years, but it mostly depends on what credit you’re referring to.

Markos Banos

Markos M. Baños Cabán, Esq., is the Director of Resolutions at Community Tax LLC, where he leads a team of practitioners and service professionals dedicated to resolving complex tax conflicts, including IRS audits, tax liens, and tax debt. A licensed attorney, tax practitioner, and notary public in Puerto Rico, Markos combines his extensive legal expertise and management skills to deliver exceptional results and reduce stress for his clients. He holds a Juris Doctor from the University of Puerto Rico School of Law and has experience in a variety of legal fields, as well as industrial management. Bilingual in English and Spanish, Markos is also a published researcher with a passion for delivering outstanding service.